Good (Bad) Banks and Good (Bad) Investments: At the right price.

Musings on Markets

MAY 7, 2023

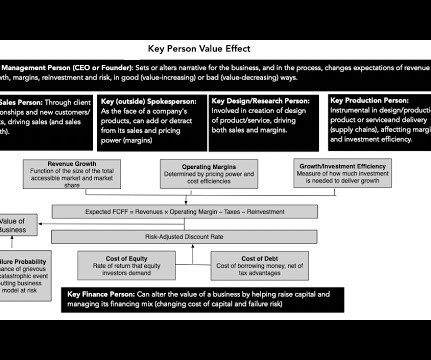

I also used the banking framework to argue that good banks have stickier deposits, with a higher precent of these deposits being non-interest bearing, that they invest in loans and investment securities on which they earn interest rates that cover and exceed the default risk in these investments. All Equity, All the time!

Let's personalize your content