M&A Industry Trends: What Sectors Have the Best-Selling Businesses?

Viking Mergers

FEBRUARY 23, 2023

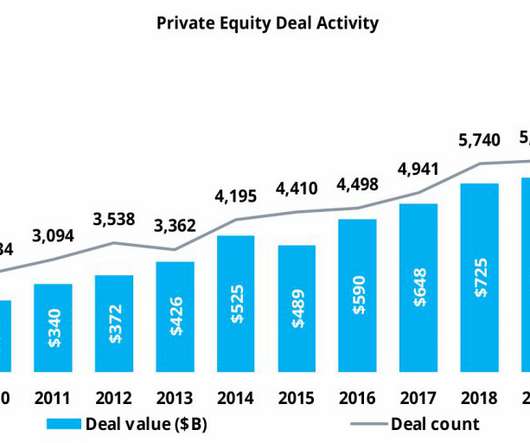

Mergers and acquisitions are generally most common in the technology, healthcare, financial services, and retail sectors. But some industries — including manufacturing and finance — saw more M&A action in 2022 than others. Technology, Media, and Telecommunications (TMT) Technology still sees the most M&A deals of any industry.

Let's personalize your content