Data Update 1 for 2021: A (Data) Look Back at a Most Forgettable Year (2020)!

Musings on Markets

JANUARY 9, 2021

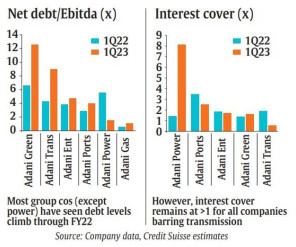

The second was that, starting mid-year in 2020, equity markets and the real economy moved in different directions, with the former rising on the expectations a post-virus future, and the latter languishing, as most of the world continued to operate with significant constraints.

Let's personalize your content