What Are SPACs?

Benchmark Report

MAY 9, 2022

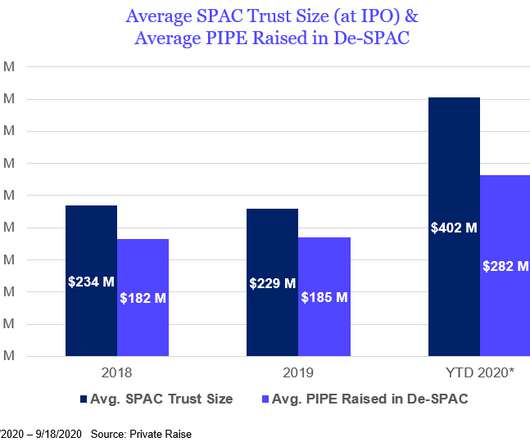

A SPAC (Special Purpose Acquisition Company) is a company with no business operations that is formed solely to raise capital through an IPO to purchase another existing company. Although SPACs have exploded in popularity in the past few years, they have been around since the early 1990s.

Let's personalize your content