The Venture Capital Case Study: What to Expect and How to Survive

Brian DeChesare

JULY 12, 2023

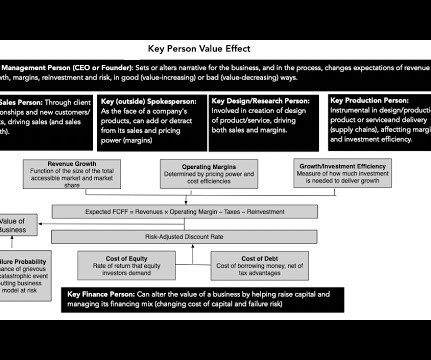

There’s plenty of information online about case studies in finance interviews (IB, PE, etc.), but the venture capital case study remains a bit mysterious. What Do Venture Capitalists Look for in an Early-Stage Investment? So, should we do the deal?

Let's personalize your content