Valuation for growth startups and maturity stage companies

Equidam

JUNE 21, 2023

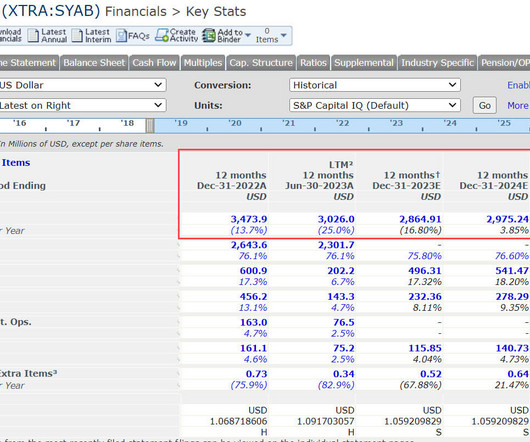

Use Equidam to calculate a fair valuation for your company at any stage of development, with the expansion of our industry leading methodology to account for risk and growth potential at later stages. In response to this, we’ve expanded our methodology to account for two new development stages: Growth and Maturity.

Let's personalize your content