The Compensation Committee’s Evolving Role in Human Capital Management

Harvard Corporate Governance

OCTOBER 31, 2023

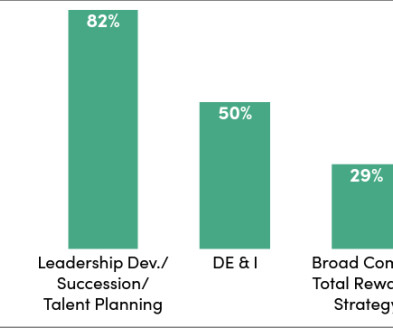

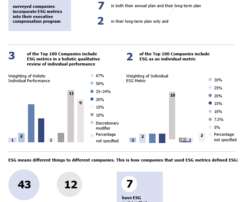

Many leaders delved into human capital management (HCM) when the economy was booming, just before the Great Resignation. Boards and compensation committees worked to understand talent issues and make their companies more attractive, inclusive, and engaging. This post is based on a NACD Directorship magazine publication.

Let's personalize your content