Regulatory Spotlight on Private Funds

Harvard Corporate Governance

NOVEMBER 19, 2023

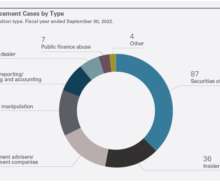

In remarks last week, SEC Director of Enforcement, Gurbir Grewal, noted that, “[w]hile we have not yet released our 2023 fiscal year-end numbers, I can give you a sneak preview: we had another incredibly productive year on behalf of the investing public.” [1]

Let's personalize your content