Emerging trends in ESG governance for 2023

Harvard Corporate Governance

MARCH 26, 2023

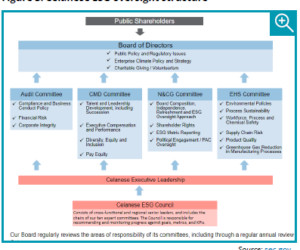

Further, the broad constellation of topics comprising ESG often doesn’t fit neatly into any one board committee’s charge. As a result, companies increasingly are opting for ESG governance frameworks that allocate responsibilities to various combinations of board committees and the full board.

Let's personalize your content