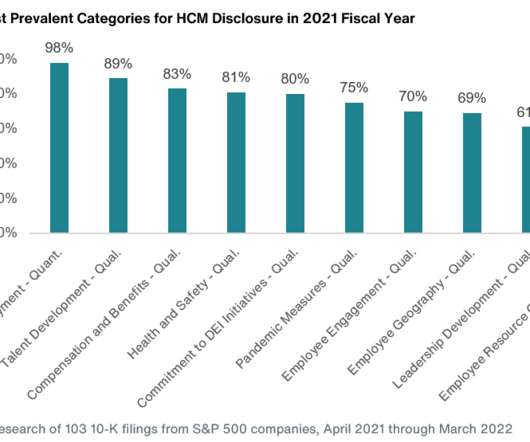

Key Themes of Human Capital Management Disclosure

Harvard Corporate Governance

MAY 16, 2022

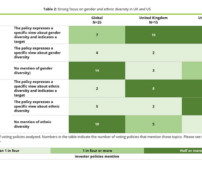

However, within the most prevalent topics for disclosure, we are observing more data being included, particularly when it comes to diversity, equity and inclusion. However, individual companies are disclosing more details on these topics, leading to more robust disclosures. Public companies in the United States (U.S.)

Let's personalize your content