The Evolution of ESG Reports and the Role of Voluntary Standards

Harvard Corporate Governance

NOVEMBER 21, 2022

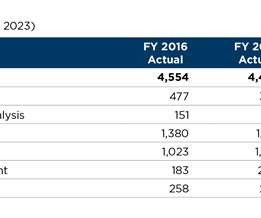

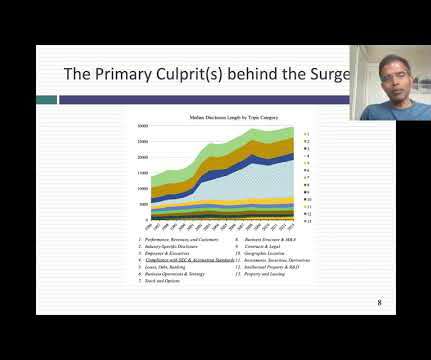

At the start of the 21st century, almost no companies released ESG-related disclosures, but by 2021, most large publicly traded U.S. We study ESG reports at two units of analysis: the document-year level and document-topic year level (“the topic level,” going forward). We next study the content in these reports (i.e.,

Let's personalize your content