For or against? The year in shareholder resolutions—2023

Harvard Corporate Governance

APRIL 29, 2024

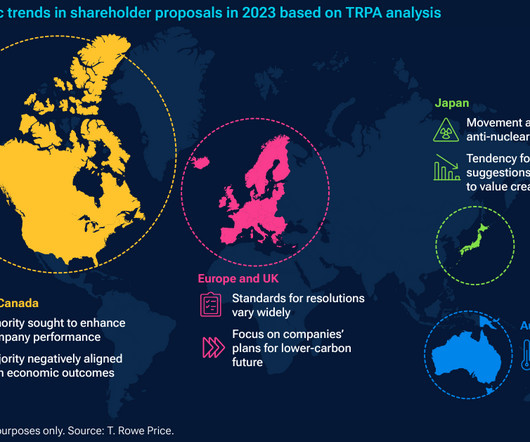

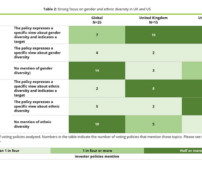

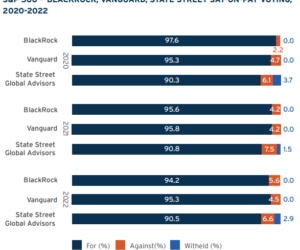

This is the fourth year that we have published analysis of our voting results on shareholder resolutions on environmental, social, and political topics. [1] Brown is Head of Governance for EMEA and Asia-Pacific at T. Rowe Price. This post is based on their T. Rowe Price memorandum. and Canada.

Let's personalize your content