How Does Corporate Ownership Affect Employee Compensation?

Reynolds Holding

OCTOBER 17, 2023

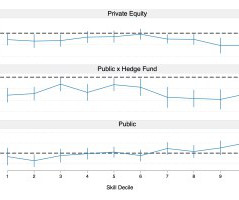

Over the past 30 years, private equity firms and hedge funds have reshaped the landscape of corporate ownership. By 2022, firms under private equity management employed over 11 million people, nearly 10 percent of the U.S. For instance, private-equity-owned companies pay 4.9

Let's personalize your content