The Shift From a Seller's Market To a Buyer's Market When Interest Rates Rise

Benchmark Report

FEBRUARY 18, 2022

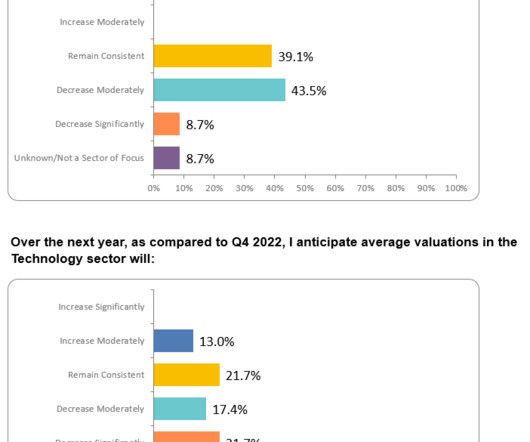

So if you are a business owner considering selling your company, the good news is that right now, it's a seller's M&A market. That's up 38% from the same quarter in 2020—and more than any other quarter on record. When market conditions shift, buyers have the upper hand in deal negotiations.

Let's personalize your content