Startup Failure

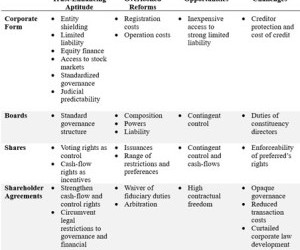

Harvard Corporate Governance

SEPTEMBER 29, 2023

Venture-backed startups famously aim for “exit.” Success for startups is often framed as reaching a liquidity event, or exit, that provides financial returns and rewards to the investors, founders, and employees. Most venture-backed startups, however, never reach either of these paths, or if they do it is in a state of distress.

Let's personalize your content