Data Update 4 for 2024: Danger and Opportunity - Bringing Risk into the Equation!

Musings on Markets

JANUARY 28, 2024

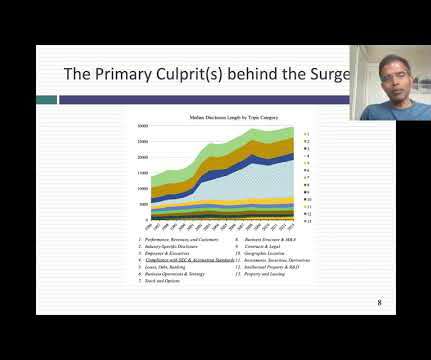

It is therefore healthy to know when to stop researching, accepting that your analysis is always a work-in-progress and that decisions have to be made in the face of uncertainty. Using the construct from the last section, I will start by looking at price-based risk measures and then move on to intrinsic risk measures in the second section.

Let's personalize your content