Why grant options over existing shares?

Vested

SEPTEMBER 13, 2023

What are the advantages of granting options over existing shares? Check out our quick guide on options, shares and dilution to find out. And why do it?

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

share-options

share-options

Vested

SEPTEMBER 13, 2023

What are the advantages of granting options over existing shares? Check out our quick guide on options, shares and dilution to find out. And why do it?

Vested

OCTOBER 25, 2022

In the UK, more SMEs than ever are implementing Enterprise Management Incentives (EMIs) and other tax-advantaged share and share option schemes.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Benzinga

APRIL 13, 2023

Pursuant to the Agreement, GFG issued a total of 1,213,592 common shares of the Company to IEP at a deemed value of C$0.1236 per common share based on the VWAP for the five previous trading days. The common shares issued will have a statutory hold period of four months and one day from the date of issuance.

Benzinga

APRIL 11, 2023

(NYSE: STNG ) ("Scorpio Tankers" or the "Company") announced today that it has exercised the purchase options on six ships and that it has repurchased its common shares in the open market. Repurchase of Common Shares Recently, the Company purchased 396,706 of its common shares in the open market at an average price of $54.41

Benzinga

FEBRUARY 1, 2023

Rapid7, Inc (NASDAQ: RPD ) consulted Goldman Sachs Group, Inc (NYSE: GS ) for advice on strategic options, including a possible sale after attracting acquisition interest, Reuters reports Wednesday. The cybersecurity firm hired. Full story available on Benzinga.com

Financial Times M&A

MARCH 21, 2023

US regional bank has been among the hardest hit in the fallout from Silicon Valley Bank’s collapse

Harvard Corporate Governance

MARCH 12, 2024

In the IPO, the SPAC sells units, which consist of redeemable shares and derivative securities like warrants or rights. Investors have the option to redeem their shares at the initial issue price before the merger, and they can keep and trade rights and warrants even after redemption. In 2021, the U.S. As Ghang et al.

Harvard Corporate Governance

APRIL 17, 2024

This proxy season, some of the world’s biggest fund managers are launching or expanding pass-through voting programs to give their fund investors a say on how shares of portfolio companies are voted. more…)

Harvard Corporate Governance

MAY 28, 2022

Public companies in a number of sectors have recently experienced a significant decline in their share price. This goal can be undermined when stock options awarded during better times are “underwater” and have therefore lost much of their incentive value. Structuring Repricings. One-for-One Exchanges. more…).

Harvard Corporate Governance

JULY 16, 2023

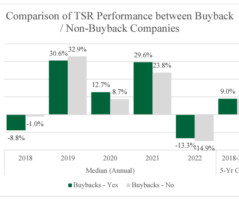

Wang; and Share Repurchases, Equity Issuances, and the Optimal Design of Executive Pay (discussed on the Forum here ) by Jesse M. Although the use of per share metrics is common in incentive plans, most of these companies balance per share metrics with other performance categories, reducing the impact buybacks have on incentive payouts.

Benzinga

MAY 15, 2024

(CSE: PRME ) (" Prime " or the " Company ") announces that it has entered into a share purchase agreement dated May 14, 2024 (the " Share Purchase Agreement ") with 9296-0186 Québec Inc. (" 9296 "), the shareholders of 9296 (together with 9296, the " Vendors "), and Angelpart Ventures Inc.,

Benzinga

APRIL 19, 2024

The CBG Group no longer holds any common shares of Canopy, as a result, the company said on Thursday. The CBG Group no longer holds any common shares of Canopy, as a result, the company said on Thursday. Each exchangeable share is convertible, at the option of the holder, into one common share.

Harvard Corporate Governance

MAY 6, 2024

Such funds often seek the adoption of corporate policies that would increase short-term stock prices, such as increasing share buybacks, selling or spinning off one or more businesses of a company or selling the entire company. Approximately 17% of S&P 500 companies have a known activist holding more than 1% of their outstanding shares.

Benzinga

MAY 9, 2024

What Happened : Paramount Global is currently in talks to share its financial information with Sony and Apollo, who are both interested in acquiring the U.S. Paramount’s special committee, responsible for evaluating the company’s options, recently allowed an exclusivity period with Skydance Media to expire.

Harvard Corporate Governance

FEBRUARY 1, 2024

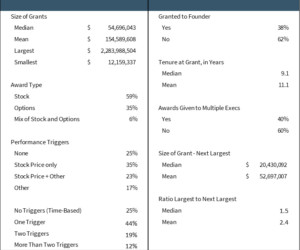

The plan offers Musk the opportunity to secure 12 total tranches of options, each representing 1% of Tesla’s total outstanding shares as of January 21, 2018. He claims that Tesla, Inc.’s s directors breached their fiduciary duties by awarding Elon Musk a performance-based equity-compensation plan.

Benzinga

OCTOBER 6, 2022

While the announcement sent shares of the social media platform soaring, some investors may have profited early from the news. The proposal was confirmed by Twitter, which saw its shares halted with news pending. Options traders could have also profited big. ” On Sept. 29, Twitter had 11,000 in.

Vested

MARCH 27, 2024

But just in case this is all new to you, EMI is a government-backed, tax-friendly share option scheme for UK startups and SMEs. If you're reading this, you're probably familiar with Enterprise Management Incentives (EMIs).

Reynolds Holding

APRIL 22, 2024

SVE Promoted a Clever Idea For a moment in time, SVE created a marketplace where shareholders can sell their votes in a company without selling the underlying shares. Activists that need extra votes for an AGM could post bids for shares. Give its short tenure and small impact, SVE did attract more than its share of attention.

RNC

JANUARY 16, 2024

Introduction: Within the ever-changing startup landscape, stock options may play a significant role in an employee’s benefits package. This Startup Stock Option Survival Guide will go over important pointers to keep your equity stake safe and enhance its worth. Your stock options’ value may be impacted by dilution.

Harvard Corporate Governance

AUGUST 7, 2023

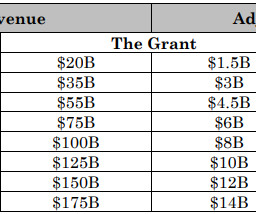

A 2005 accounting change that required companies to record the fair value of equity awards in the financial statements further decreased the attractiveness of large-scale option awards. This trend has reversed in recent years, with executives receiving nine-figure awards once again appearing on annual lists of the highest paid CEOs.

Benzinga

MAY 4, 2023

Option Care Health Inc (NASDAQ: OPCH ) and Amedisys Inc (NASDAQ: AMED ) have agreed to combine in an all-stock, valuing Amedisys at approximately $3.6 Each Amedisys share will be exchanged for 3.0213 shares of Option Care Health, equivalent to $97.38 per Amedisys share. Full story available on Benzinga.com

Law 360 M&A

MARCH 14, 2024

Manhattan federal prosecutors announced Thursday that the former CEO of real estate investment firm ArciTerra was indicted, alleging he issued a bogus $77 million offer for WeWork shares in an ultimately failed attempt to cash in on call options after juicing the stock price.

Harvard Corporate Governance

NOVEMBER 8, 2022

Board culture—the shared values, beliefs, assumptions, and expectations that influence behavior in the boardroom—plays a considerable role in the board’s ability to govern in an effective and efficient manner. Gregory, Sidley Austin LLP, on Tuesday, November 8, 2022 Editor's Note: Holly J. This post is based on her Sidley memorandum.

Harvard Corporate Governance

MARCH 29, 2022

Wang (discussed on the Forum here ); and Share Repurchases, Equity Issuances, and the Optimal Design of Executive Pay by Jesse Fried (discussed on the Forum here ). Securities and Exchange Commission (SEC) on its proposed rules to modernize the disclosure of share repurchases. [1] Introduction and Background. more…).

Cooley M&A

NOVEMBER 20, 2023

Challenge #1: Managing equity incentive plan share reserves When a buyer uses shares in lieu cash on hand or financing as consideration in a transaction, it often puts pressure on the buyer’s share reserves to the extent shares are needed to assume target awards or incentivize acquired employees with new equity.

Benzinga

OCTOBER 26, 2022

In addition, Canopy also controls a conditional ownership position , assuming conversion of its exchangeable shares and the exercise of its option though excluding the exercise of its warrants, of approximately 13.7% million exchangeable shares, the TerrAscend option to acquire 1 million common shares and 22.5

Benzinga

APRIL 16, 2024

of a share of McEwen's common stock for each share of Timberline's common stock (the "Exchange Ratio"), representing a value of US$0.102 per Timberline share, calculated based on the 20-day volume weighted average trading price of McEwen's shares on the NYSE at the close on April 15 th , 2024.

Benzinga

MARCH 28, 2024

A rival bidder was believed to have consulted with Bechtolsheim who, upon learning this information, immediately traded Acacia options through the accounts of a close relative and an associate. The SEC alleged that Bechtolsheim’s trading generated illegal profits of $415,726 through the accounts of his relative and associate.

Benzinga

NOVEMBER 22, 2022

8 million of its common shares at a purchase price of $3.30 per share priced at-the-market under Nasdaq rules. In addition, the company has issued to the investors in the offering unregistered preferred investment options to purchase up to an aggregate of 3.3 million common shares. The aggregate gross.

Viking Mergers

MAY 9, 2022

There are a variety of business exit strategy options, and the best option for you may not be the same as another person or business. In this article, we will discuss what an exit strategy is and some of the options available to you as a business owner. It means offering shares in the company to the public for purchase.

Benzinga

MARCH 12, 2024

For further information regarding the Option Agreement, see the Company's press release dated November 21, 2023. In accordance with the Option Agreement, Ranchero has issued 835,000 common shares in the capital of Ranchero to Recharge. The common shares are subject to a four-month hold period ending on July 13, 2024.

Harvard Corporate Governance

DECEMBER 17, 2023

Shadow trading involves an investor possessing material non-public information (MNPI) about “Company A” but trading in the securities of “Company B,” another company with which Company A shares some form of close connection in the market. The SEC has alleged that Incyte was a closely comparable company to Medivation.

Vested

JULY 21, 2023

Stock option schemes (or what we tend to call share option schemes in the UK) are a surefire method of uniting teams towards business growth - and they’re not confined by borders.

Benzinga

MARCH 7, 2024

Shares of SaaS platform E2open Parent Holdings, Inc (NYSE: ETWO ) are trading higher after it initiated a strategic review for the company. The review will evaluate options to enhance shareholder value and further strengthen e2open’s position in the supply chain management software market.

Benzinga

JANUARY 13, 2023

World Wrestling Entertainment Inc (NYSE: WWE ) has retained The Raine Group, LLC as financial advisor, Kirkland & Ellis LLP as legal advisor, and August LLC as strategic communications advisor to support its review of strategic options.

Vested

FEBRUARY 22, 2024

An initiative of HMRC, EMI is designed to empower UK businesses, allowing them to offer share options to their employees in the most tax-efficient way possible. Well, you're in good company - over 14,000 UK-based businesses have launched an EMI scheme. If you don't know what I'm talking about, I'll catch you up.

Reynolds Holding

APRIL 3, 2024

Yet those that traded in options on the shares can also be harmed. 2022) to describe the issues related to including options in a certified class in the face of substantial opposition from defendants. Options Market Efficiency Since the Third Circuit’s decision in Deutschman v. Securities Litigation (N.D. John Fund v.

Harvard Corporate Governance

OCTOBER 9, 2023

See “ Share Buyback Disclosures – Narrative Disclosures ” below for similar requirements applicable to a company’s adoption or termination of a Rule 10b5-1 trading arrangement. For quarterly reports on Form 10-Q, this disclosure is to be provided in Part II, Item 5(c).

NYT M&A

APRIL 14, 2022

Elon Musk could pledge his Tesla shares, borrow from banks or team up with private equity to raise the funds. Each option comes with caveats.

Farrel Fritz

MARCH 4, 2024

So why do so many shareholder buy-sell agreements require that the shares be purchased for book value? which enforced a buy-sell provision fixing the share price at only 70% of book value (31 AD3d 172, 175 [1st Dept 2006]). NRS’s shares are subject to a shareholders’ agreement governed by New York law.

Benzinga

DECEMBER 5, 2023

The shares issued will have a buyback option as well as a lockout/leak agreement. See also: Branded Legacy Shares Trading Higher On Getting 'One Step Closer To Full Vertical Integration' Why It Matters The deal significantly expands. The acquisition is a combination of preferred series stock and cash.

Benzinga

SEPTEMBER 15, 2023

(OTCQB: GRCMF ), (" Green Shift ", " GCOM " or the " Company ") is pleased to announce that it has completed the previously announced acquisition (the " Transaction ") of an existing option (the " Option ") to purchase a 100% interest in the Armstrong Lithium Project (the " Armstrong Project " or the " Project ").

Benzinga

SEPTEMBER 6, 2023

per share in cash. Last month, NextGen Healthcare said it is exploring various strategic options, including possibly a company sale. The per-share. Thoma Bravo , a software investment firm, agreed to acquire NextGen Healthcare Inc (NASDAQ: NXGN ) for $23.95 Full story available on Benzinga.com

Appraisers Blog

MAY 23, 2023

I have already shared my experience with one client where I lost all other work with them that wasn’t VA. I also shared that the regulatory agencies don’t really care, or at least they don’t care about small time stuff. Only option is to sue people personally, or take it and move on to new clients. In reply to Tobby.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content