Data Update 3 for 2024: Interest Rates in 2023 - A Rule-breaking Year!

Musings on Markets

JANUARY 24, 2024

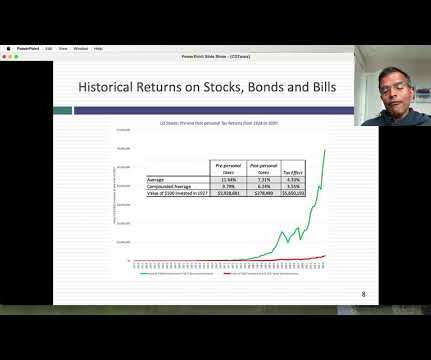

As we start 2024, the interest rate prognosticators who misread the bond markets so badly in 2023 are back to making their 2024 forecasts, and they show no evidence of having learned any lessons from the last year.

Let's personalize your content