Disentangling the value of ESG scores and classification of sustainable investment products

Harvard Corporate Governance

MARCH 22, 2024

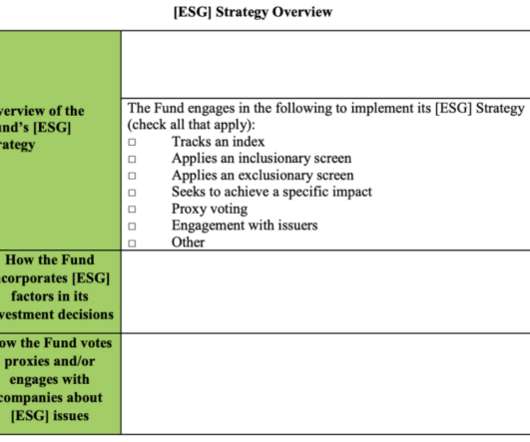

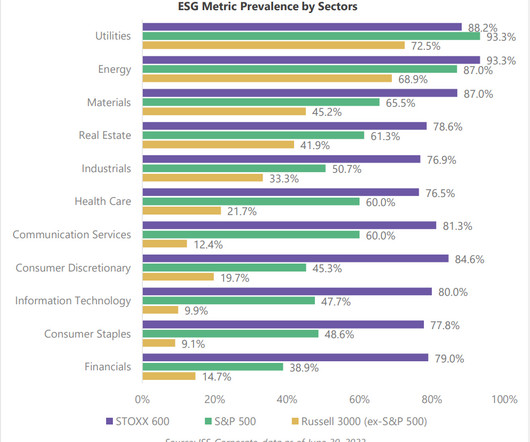

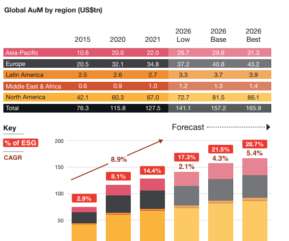

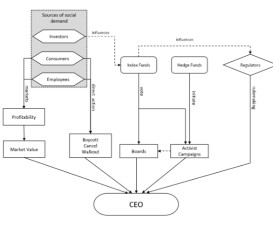

Related research from the Program on Corporate Governance includes The Perils and Questionable Promise of ESG-Based Compensation (discussed on the Forum here ) by Lucian A. Confusion surrounding ESG (environmental, social, and governance) data and mislabeling of sustainable investment products complicates adoption and regulation.

Let's personalize your content