Perspectives Paper: Human Capital

IVSC

MAY 31, 2022

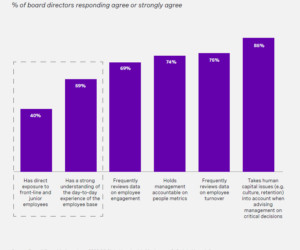

Human Capital is the foundation from which all intangible assets are created, yet our understanding of Human Capital value creation and rigor around value measurement is less evolved than other intangible assets. Evidence suggests that investors require more information on the impact Human Capital has on enterprise value.

Let's personalize your content