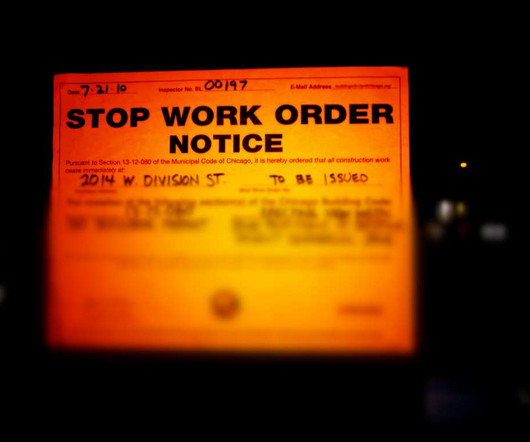

Feds Probing TD Bank's Anti-Money Laundering Compliance

Law 360 M&A

AUGUST 24, 2023

subsidiary of Canada's Toronto-Dominion Bank revealed in a shareholder report Thursday that it has received inquiries from regulatory and law enforcement authorities, including the U.S. Department of Justice, regarding its compliance with anti-money laundering regulations and that it expects penalties in the end.

Let's personalize your content