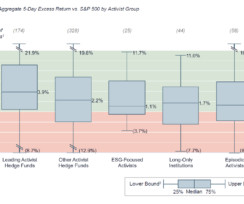

Do Activists Beat the Market?

Harvard Corporate Governance

AUGUST 1, 2023

Posted by Mary Ann Deignan, Rich Thomas, and Kathryn Night, Lazard, on Tuesday, August 1, 2023 Editor's Note: Mary Ann Deignan is Head of Capital Markets Advisory, and Rich Thomas and Kathryn Night are Managing Directors in the Capital Markets Advisory group at Lazard. This post is based on a Lazard memorandum by Ms.

Let's personalize your content