Delaware Supreme Court Holds MFW Inapplicable Based on Banker Conflict Disclosure Deficiencies

Harvard Corporate Governance

MAY 13, 2024

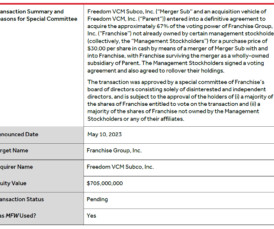

The Supreme Court held that the majority-of-the-minority stockholder vote approving the transaction was not fully informed, based on inadequate disclosure of conflicts of interest on the part of financial advisors to the special committee of Inovalon’s board. M&F Worldwide Corp. – the MFW decision.

Let's personalize your content