IPOs and SPACs: Recent Developments

Harvard Corporate Governance

FEBRUARY 20, 2023

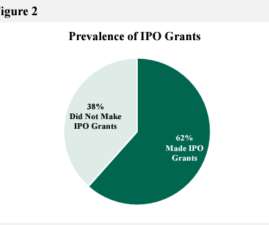

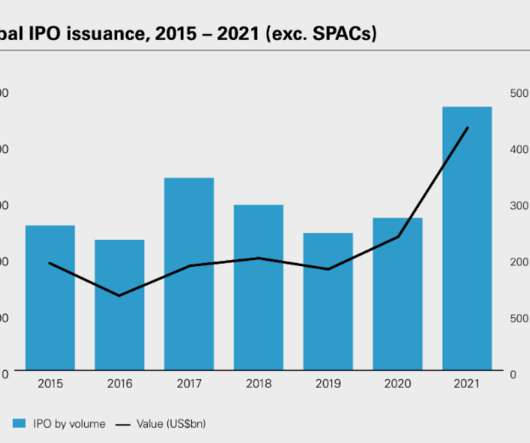

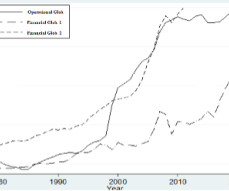

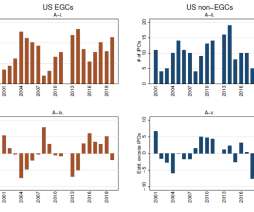

The review article, IPOs and SPACs: Recent Developments , forthcoming in the Annual Review of Financial Economics , examines recent developments in the IPO market. These IPOs have faced criticism for leaving too much money on the table, defined as the difference between the market value of the shares sold and the issue proceeds.

Let's personalize your content