Index Providers: Whales Behind the Scenes of ETFs

Harvard Corporate Governance

AUGUST 8, 2023

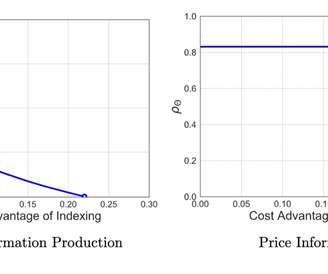

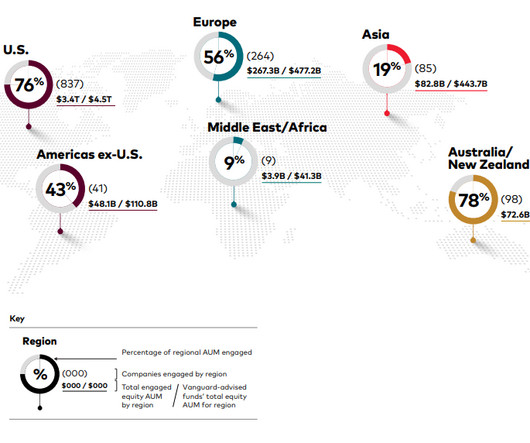

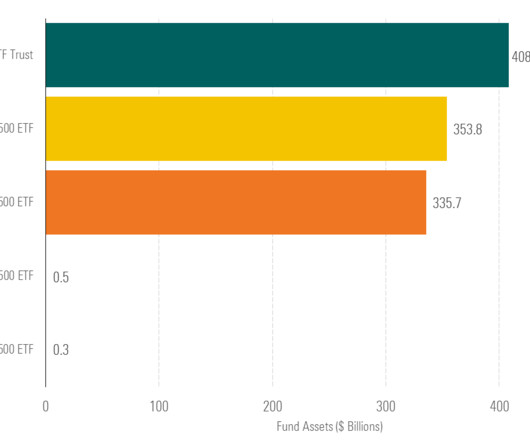

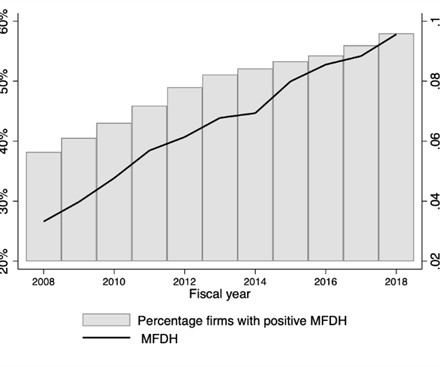

By design, the vast majority of ETFs passively replicate the performance of an underlying index, which in most cases is constructed and maintained by a designated index provider. This post is based on their recent paper , forthcoming in the Journal of Financial Economics.

Let's personalize your content