How Is Intellectual Property Valued?

Benchmark Report

FEBRUARY 20, 2023

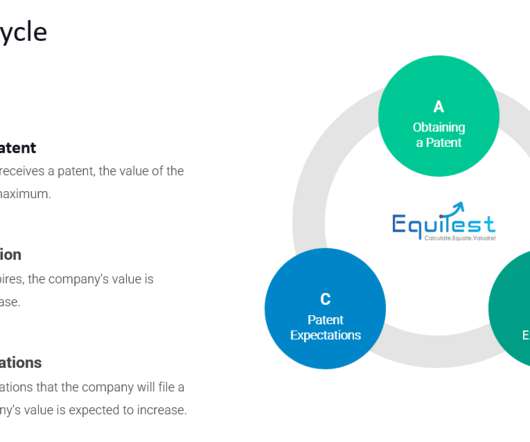

Intellectual property (IP) is a non-physical creation of the mind or the product of a company's work or reputation. It is essentially ideas that are executed to become successful business assets and are often copyrighted, under patent, trademarked, or considered trade secrets, to protect from unauthorized use.

Let's personalize your content