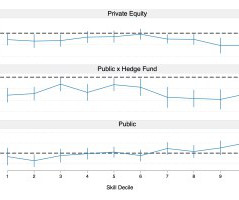

2023 Activism Recap

Harvard Corporate Governance

MARCH 11, 2024

Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism (discussed on the Forum here ) by Lucian A. A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System (discussed on the Forum here ) by Leo E.

Let's personalize your content