Assessing ESG-Labeled Bonds

Harvard Corporate Governance

MAY 6, 2022

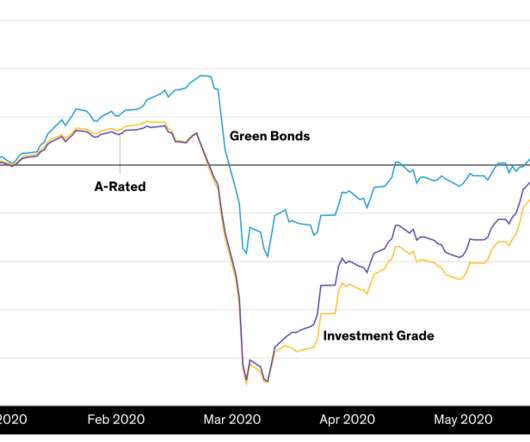

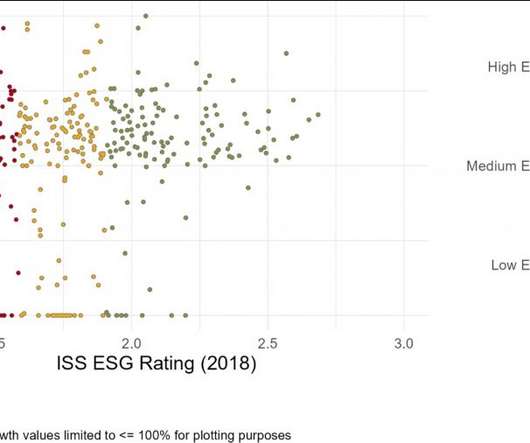

Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Increasingly, today’s fixed-income market presents unique opportunities for responsible investing in the form of environmental, social and governance (ESG) labeled bonds. Schanzenbach and Robert H.

Let's personalize your content