The Corporate Investment Benefits of Mutual Fund Dual Holdings

Harvard Corporate Governance

FEBRUARY 2, 2024

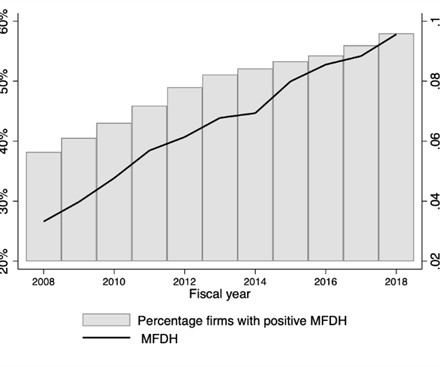

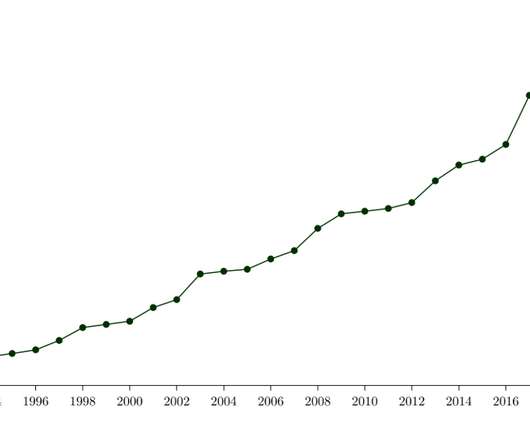

Bebchuk and Scott Hirst; and The Limits of Portfolio Primacy (discussed on the Forum here ) by Roberto Tallarita. publicly traded firms. In the last decade, investment in corporate bonds has seen a surge through bond mutual funds. more…)

Let's personalize your content