Are Financial Firms Ready for Climate Regulation?

Reynolds Holding

APRIL 7, 2024

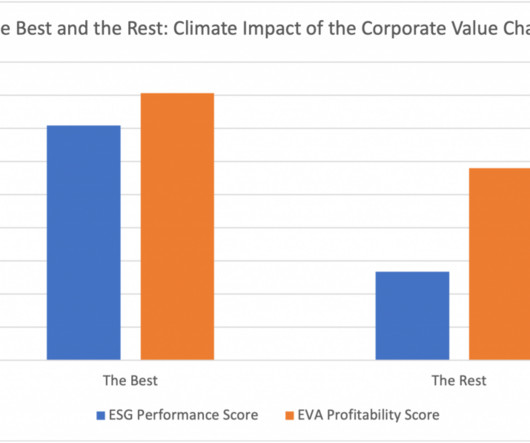

For most companies in the financial sector, though, the bulk of relevant emissions are categorised as Scope 3 indirect emissions, specifically, financed emissions. Attention to Scope 3 emissions is likely to grow, as the financial sector has a key role to play in financing a transition to a low-carbon economy. Some jurisdictions—e.g.,

Let's personalize your content