What the Rise of Indexing Means for Corporate Governance

Reynolds Holding

DECEMBER 11, 2022

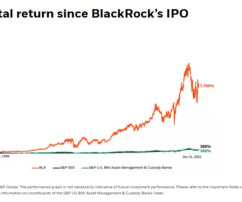

Domestic passive funds and ETFs now manage more than half of all assets under management (AUM) of domestic equity mutual funds and ETFs, and the Big Three passive fund managers (BlackRock, State Street, and Vanguard) cast over a quarter of the votes in S&P 500 companies.

Let's personalize your content