Valuing Small Business Start-Ups

BV Specialists

JUNE 19, 2023

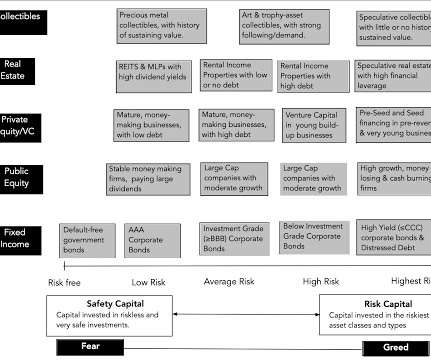

We receive several valuation inquiries every year from companies still in their infancy stages that are looking to attract new investment through private equity or by bringing in additional partners with the right talent to help them achieve their goals.

Let's personalize your content