Interest Rates, Earning Growth and Equity Value: Investment Implications

Musings on Markets

MARCH 25, 2021

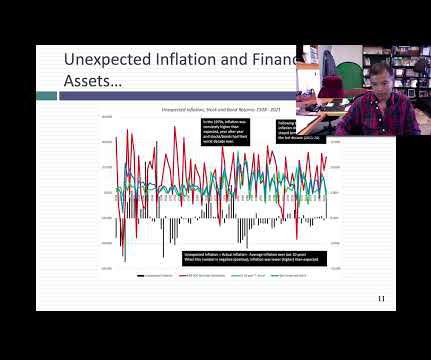

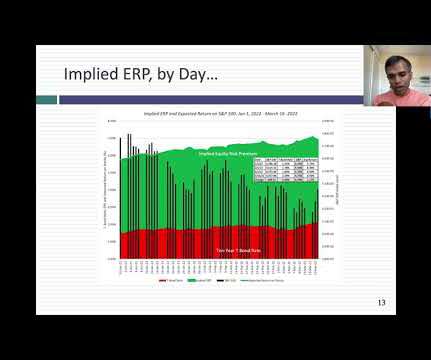

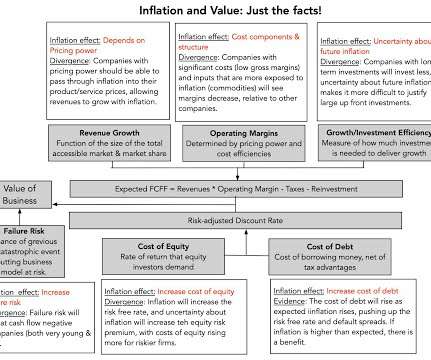

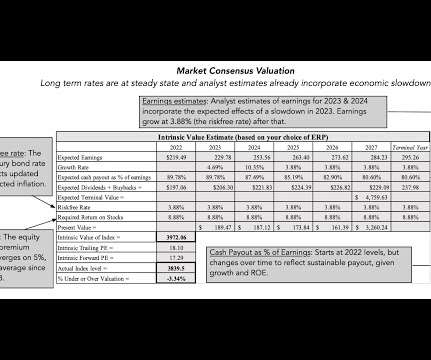

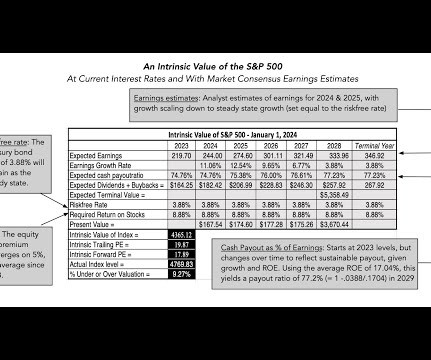

The first quarter of 2021 has been, for the most part, a good time for equity markets, but there have been surprises. The first has been the steep rise in treasury rates in the last twelve weeks, as investors reassess expected economic growth over the rest of the year and worry about inflation.

Let's personalize your content