New Owner for High Times Magazine Bets on a Counterculture Comeback

NYT M&A

JUNE 18, 2025

The anti-establishment magazine, which was taken over by a private equity firm in 2017, was purchased this week by an avid fan and reader for $3.5 million.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

NYT M&A

JUNE 18, 2025

The anti-establishment magazine, which was taken over by a private equity firm in 2017, was purchased this week by an avid fan and reader for $3.5 million.

Harvard Corporate Governance

AUGUST 14, 2022

Posted by Mandy Wright, Directorship, on Sunday, August 14, 2022 Editor's Note: Mandy Wright is senior editor of Directorship magazine. Dry powder is partially fueling these transactions as private equity firms compete to buy the best companies at the best prices, pushing them to look at the public markets for inspiration.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Global Finance

OCTOBER 31, 2024

The financing structure lets the company count bonds as equity, hopefully eschewing concerns about its debt load, a critical factor in maintaining its credit rating. Boeing shareholders get some protection from immediate dilution, as the mandatory convertible bonds will convert into equity at a premium.

Global Finance

JUNE 17, 2024

A 10-year veteran at DBS Bank, Karoonyavanich recently expanded his role to cover all Equity Capital Markets business for the bank globally when the firm merged its equities, fixed income and brokerage businesses to form a new Investment Banking unit. Its Hong Kong market share surged from a mere 0.2% in 2021 to an impressive 6.7%

The Guardian M&A

JULY 17, 2024

Potential bid by CVC Capital Partners believed to be structured to back newspaper group’s management team Business live – latest updates The private-equity group behind the Six Nations tournament and English Premiership Rugby is considering a bid for the Telegraph, before the deadline for the first round of the auction of the newspaper group this week. (..)

Global Finance

APRIL 7, 2025

Serie A, B, and C teams are all in play as private equity firms join the mad rush to buy a dwindling number of assets. But whats getting the ball rolling this time is major backing from US-based private equity (PE) investors. For private equity, the story is very different, because they typically adopt a more structured approach.

Global Finance

APRIL 6, 2025

Faced with low yields, insurers are deepening ties with private equity and asset managers, turning to alternative investments amid regulatory headwinds. Now insurers are embracing alternative investments like private debt, infrastructure, and real estateoften partnering with asset managers and private equity firms to boost yields.

Global Finance

JUNE 5, 2025

GF : What about real estate and equities? As for equities, a few months ago, I would have said we have a long way to go. The post Galaxy Digital: Tokenization Approaches The Mainstream appeared first on Global Finance Magazine. Tokenization technology can create a lot of efficiencies there.

Global Finance

DECEMBER 6, 2024

Today, it encompasses a broad spectrum of ambitions, from climate resilience to social equity, requiring tailored solutions that align with each clients values. Safra Sarasin Chief Sustainability Officer Daniel Wild Q&A appeared first on Global Finance Magazine. The post Sustainable Investing Goes Mainstream: J.

The Guardian M&A

JUNE 11, 2025

Exclusive: Cross-party group including peers warns of risk of ‘potential Chinese state influence’ in private equity firm A cross-party group of MPs and peers has called on ministers to investigate how a US private equity company is funding its £500m takeover of the Telegraph.

Appraisers Blog

APRIL 21, 2023

Related Posts: Fannie's 'Equity' Plan: The Drinking Game What makes equity so invidious as a governing tenet is that it involves not just helping people of one racial… Only Blacks Need Apply. Don’t fret over it, just subscribe to a magazine. Don't Fret Over It Got a low credit score and can’t get a loan?

Global Finance

JULY 31, 2024

This combination of expected revenue increase from higher tariffs, the launching of 5G services, and supportive government policies (reduced spectrum costs, longer amortization of dues, and conversion of debt owed to the government to equity) have likely buoyed the confidence of investors and led to several successful issuances of new equity.

Global Finance

FEBRUARY 28, 2025

The post Beyond Unicorns: Andreessens Venture Capital Vision appeared first on Global Finance Magazine. In 2019, Vinod Khosl, founding CEO of Sun Microsystems and founder of Khosla Ventures, told Sam Altman: 90% of VCs do not bring any value to startups, and 70% even harm them.

The Guardian M&A

MAY 23, 2025

Deal with US private equity firm will end two years of uncertainty over future of titles A consortium led by the US private equity company RedBird Capital has agreed to buy the Telegraph for 500m, bringing an end to two years of uncertainty over the future ownership of the titles.

Global Finance

JULY 2, 2024

QNBFS Chairman Adel Abdulaziz Khashabi said, “It’s important to note that SLB is one part of several key initiatives championed by the QSE to enhance the size and liquidity of Qatar’s equity market. The post Qatar Stock Market Aims To Boost Product Range And Liquidity appeared first on Global Finance Magazine.

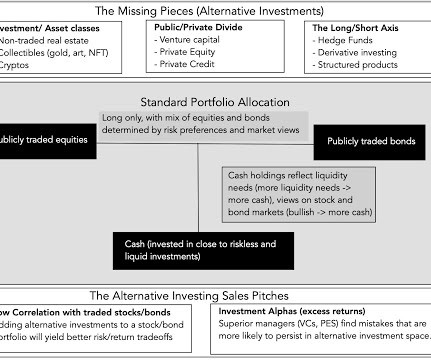

Musings on Markets

JUNE 17, 2025

For more established private businesses, some of which need capital to grow and some of which have owners who want to cash out, the capital has come from private equity investors. The payoff from doing so takes the form of "excess returns" which will supplement the benefits that flow from just diversification.

Global Finance

JULY 24, 2024

To snatch her from Lilly, Pichai offered three big incentives: a close to $10 million signing bonus, an equity grant of $13 million, and future annual bonuses that could skyrocket to 200% of her base salary. The post Incoming Alphabet CFO Knows The ABCs Of Innovation appeared first on Global Finance Magazine.

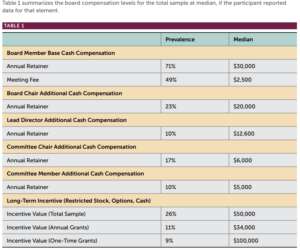

Harvard Corporate Governance

OCTOBER 11, 2022

To address this data deficiency, Compensation Advisory Partners (CAP) and Family Business and Private Company Director magazines conducts our Private Company Board Compensation and Governance Survey.

Global Finance

DECEMBER 26, 2024

This means having the right mix of debt and equity and keeping all stakeholders aligned. The post CFO Corner With Thryv Holdings Paul Rouse appeared first on Global Finance Magazine. In larger companies, roles are more siloed. GF: What keeps you up at night? GF: Whats the key to maintaining good relationships with shareholders?

Global Finance

JUNE 4, 2024

But a private equity firm’s tactics had a hand in Red Lobster’s demise, too. The post It Wasn’t Just Shrimp That Killed Red Lobster appeared first on Global Finance Magazine. When Thai Union was a 49% stakeholder, it muscled out rival shrimp suppliers and inked an expensive—and more exclusive—deal for itself.

Global Finance

JUNE 18, 2024

Several of the domestic companies looking to IPO this year are global private-equity backed where early investors are looking to cash out. In the second half of 2023 the Indian equity market crossed the $4 trillion mark and is currently valued at $4.9 As of June 14, 136 companies had successful IPOs in India, raising $6.3

Global Finance

OCTOBER 7, 2024

Benchmark tech analyst Cody Acree argues that a private equity firm like Apollo is a better fit for struggling Intel. The post Intel In Crosshairs Of Apollo, Qualcomm appeared first on Global Finance Magazine. Who benefits from Intel’s resurgence other than a core investor?” Both deals involved hefty breakup fees.

Global Finance

JUNE 6, 2024

Direct lenders can offer attractive rates with little or no equity dilution of the business, enabling companies to “make acquisitions, refinance bank lenders, consolidate [their] shareholder base, and invest in growth.” The post Alternative Financing Comes Of Age appeared first on Global Finance Magazine.

Global Finance

OCTOBER 16, 2024

Private equity firms are eager to exit their investments, sensing this market momentum.” The post US IPO Market Picks Up Steam As Election Looms appeared first on Global Finance Magazine. This dynamic, combined with strong stock market performance, has many companies considering IPOs to take advantage of current momentum.

Private Funds CFO

JANUARY 28, 2022

In the magazine: CFOs offer their advice on what you need to look out for in the new era of inflation; Private equity compensation survey findings; The future of ESG-linked loans; What CFOs can learn from chipmakers; Plus much more….

Global Finance

MARCH 2, 2025

Preqin, an alternatives research firm, is forecasting that alternative assets under managementincluding private equity and credit, venture capital, hedge funds, real estate, and infrastructure investmentswill rise from $16.8 The post Appetite For Alternative Assets Grows In Private Banking appeared first on Global Finance Magazine.

Global Finance

OCTOBER 6, 2024

Private equity firms seek operational opportunities. While the NFL is opening up to private equity investment, there are stringent rules in the NBA and the NHL around owning minority stakes. GF: So, where else in the sports ecosystem can private equity firms find opportunity? GF: Can private equity compete with nation-states?

Global Finance

JUNE 13, 2025

“As US-China trade tensions ease, Chinese equities have rebounded strongly, while ongoing US-EU tariff disputes and political uncertainties continue to weigh on US markets,” Chu said. ” The post China: CATL Supercharges Hong Kong’s IPO Market appeared first on Global Finance Magazine. .

Global Finance

MAY 1, 2025

Supported by a large team of equity specialists, Dukhan’s portfolio-management services are extensive and include equity markets, sukuk, mutual funds, and capital-protected products. Sidra focuses on global income-generating real estate, private finance, and private equity. The company has made several recent deals.

Global Finance

JUNE 6, 2025

Koller: One major trend we’ve seen is the globalization of equity markets over the last 35 years. As an individual investor, you can easily buy hundreds of international funds or even individual foreign stocks—and the same goes for investors abroad buying US equities.

Law 360 M&A

MARCH 13, 2024

The government has set out rules that would prevent foreign states from owning British newspapers and other print media, a move that could block the takeover of The Daily Telegraph newspaper and The Spectator news magazine by RedBird IMI, an Abu Dhabi-backed private equity firm.

Global Finance

JULY 23, 2024

Significantly, Mizuho CEO Masahiro Kihara said the bank will either pass on the proceeds from its sales of equity holdings to investors as dividends or invest them in growth-directed activities, and Sumitomo Mitsui aims to reduce the market value of its equity holdings to less than 20% of the value of its consolidated net assets.

Global Finance

DECEMBER 9, 2024

GF: Ethiopia is launching an equity market. One of the advantages of the South African exchange is it combines equity and debt instruments. Even if you have a lull in equity, you could have significant fixed income activity, or vice versa. In our role as a development institution, we try to provide support for markets.

Global Finance

MARCH 3, 2025

Evergreen funds are intended to attract investors further down the wealth spectrum from the traditional buyers of private equity and debt stakes. En masse , they represent a huge new source of potential capital for private equity and debt managers to tap. It feels like the latest fad, Whitt says.

Global Finance

SEPTEMBER 23, 2024

The target agrees to “merge” with the SPAC, taking its cash in exchange for an agreed slice of equity, generally a minority stake that keeps incumbent management in place. The post SPACs Try For A Comeback appeared first on Global Finance Magazine. The jury is still out.”

Global Finance

AUGUST 16, 2024

Anglo’s valuation upside no longer looks compelling on a standalone basis,” JP Morgan’s equity research team concluded, suggesting it may still be a takeover target. The post Anglo American’s Big Restructuring Aims To Refocus Mining Giant appeared first on Global Finance Magazine. The restructuring itself is a complicated affair.

Global Finance

JUNE 13, 2025

” Like many of its peers, Rowan Digital Infrastructure is sponsored by a private equity firm, Tim McGuire says. “Typically, a private equity investor will front some of the pre-development costs, which could include acquiring the land parcel and doing some of the horizontal development,” he notes.

Global Finance

OCTOBER 30, 2024

In 2023, QIA funds team invested in Ariel Alternatives’ private equity fund Project Black supporting middle-market minority-owned businesses throughout America. The post Factsheet: QIA’s Key Investments appeared first on Global Finance Magazine.

Global Finance

JUNE 7, 2024

Global Finance magazine held our Best Investment Banks and Sustainable Finance awards ceremony on the evening of April 30th at the iconic Gherkin Building in London. 11 Chapel Hill Denham’s Lanre Buluro , Managing Director Capital Markets (left) and Richard Rothwell , Director (right) collecting the Best Equity Bank in Africa award for 2024.

IVSC

JUNE 12, 2023

Srividya has advised several global and Asian alternative investment funds including sovereign wealth funds, private equity, private credit and venture capital investors as well as clients across a variety of sectors such as technology, life sciences, manufacturing, consumer products, energy & resources etc.

Global Finance

AUGUST 6, 2024

Conversations with exchanges and broker-dealers in Europe and Africa” about potentially bringing equity-linked products, i.e., American Depositary Receipts and exchange-traded funds, from those regions to the US markets via GIX are taking place, he explained. We’re still in the early stages of those discussions.”

Global Finance

JUNE 9, 2025

Asset Tokenization Studio| HEDERA Hedera’s Asset Tokenization Studio, launched last September, is an open-source toolkit that streamlines the tokenization of bonds and equities. The post The Innovators 2025: North America appeared first on Global Finance Magazine.

Global Finance

JULY 30, 2024

Earlier this year, Chicago-based Grant Thornton recently sold a stake in the firm to private equity fund New Mountain Capital to invest more quickly in technology and personnel. Sensing opportunities for consolidation, private equity (PE) firms have purchased shares in five of the top 26 US accounting firms in recent years.

Global Finance

OCTOBER 25, 2024

Of this total, $930 billion is invested in equities while the remainder is allocated to debt and hybrid instruments. Currently, FPI equity holdings account for 16.4% The post Investors’ Holdings Of Indian Stocks Top $1 Trillion appeared first on Global Finance Magazine. of India’s total market capitalization.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content