Exit Through the Virtual Door: Tips for Selling Your E-commerce Business

Viking Mergers

MAY 18, 2023

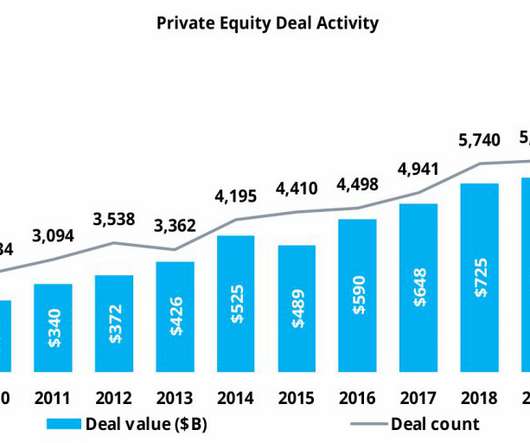

With that kind of earnings potential, you may expect it to be a seller’s market with buyers lined up to take advantage of e-commerce popularity. Since these values all mean different things to your company, an advisor or broker will use their expertise to determine the most appropriate figures to use in negotiations.

Let's personalize your content