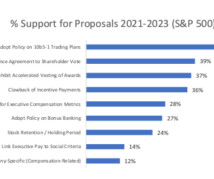

Trends in Shareholder Proposals

Harvard Corporate Governance

SEPTEMBER 1, 2023

Posted by Nathan Williams, Jamie McGough, and Donald Kalfen, Meridian Compensation Partners, on Friday, September 1, 2023 Editor's Note: Nathan Williams is a Lead Consultant, and Jamie McGough and Donald Kalfen are Partners at Meridian Compensation Partners. This post is based on their Meridian Compensation Partners memorandum. Shareholder proposals are a common part of the governance landscape.

Let's personalize your content