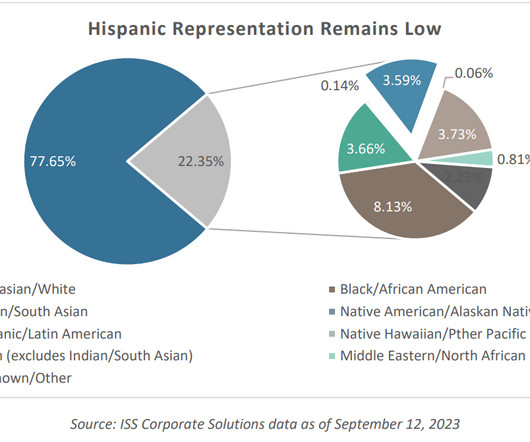

Hispanics Underrepresented on U.S. Boards Despite Recent Gains

Harvard Corporate Governance

NOVEMBER 16, 2023

Posted by Subodh Mishra, Institutional Shareholder Services, on Thursday, November 16, 2023 Editor's Note: Subodh Mishra is Global Head of Communications at Institutional Shareholder Services (ISS) Inc. This post is based on an ISS Corporate Solutions memorandum by Sandra Herrera Lopez, PhD, Vice President, ESG Content & Data Analytics at ISS Corporate Solutions.

Let's personalize your content