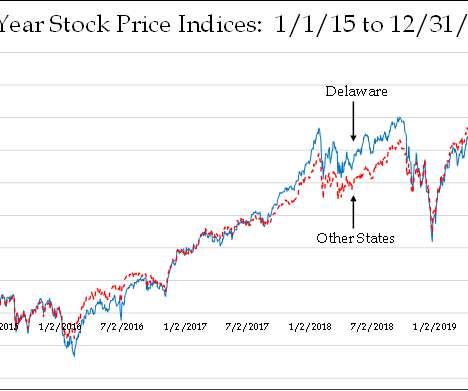

The Irrelevance of Delaware Corporate Law

Harvard Corporate Governance

OCTOBER 1, 2022

Posted by Robert J. Rhee (University of Florida), on Friday, September 30, 2022 Editor's Note: Robert J. Rhee is John H. and Marylou Dasburg Professor of Law at the University of Florida Levin College of Law. This post is based on his recent paper , forthcoming in the Journal of Corporation Law , and is part of the Delaware law series ; links to other posts in the series are available here.

Let's personalize your content