EV/EBITDA Explained: A Key Valuation Multiple for Investors

Valutico

MAY 19, 2025

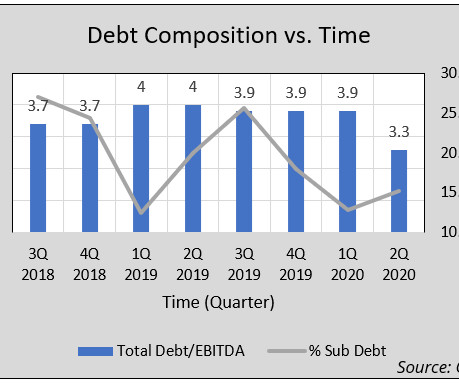

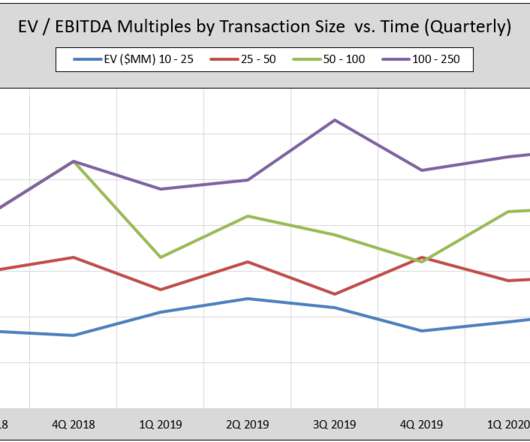

EV/EBITDA is a widely used multiple in this relative valuation approach. What is EV/EBITDA? Investors and analysts widely utilize the EV/EBITDA multiple as a key valuation metric. The multiple is calculated as Enterprise Value (EV) divided by EBITDA. Breaking down the multiple What is EBITDA?

Let's personalize your content