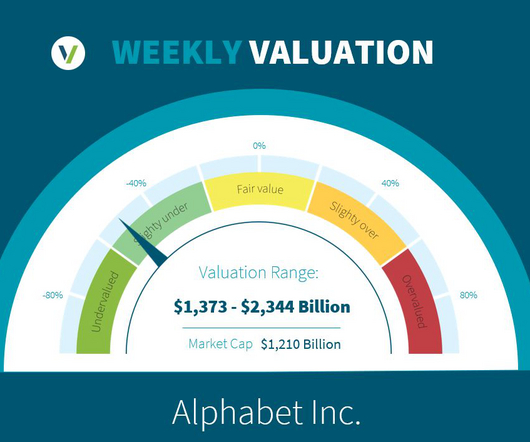

AI technology, a serious threat for Alphabet?

Valutico

FEBRUARY 21, 2023

is an American tech conglomerate, operating in various industries, including technology, advertising, autonomous driving, entertainment, and many more. Recently the Google search engine was subject to many discussions due to rising perceived threats from Artificial Intelligence (AI) technology. appeared first on Valutico.

Let's personalize your content