Middle Market Private Equity M&A Activity – Q2 2020

Value Scope

SEPTEMBER 4, 2020

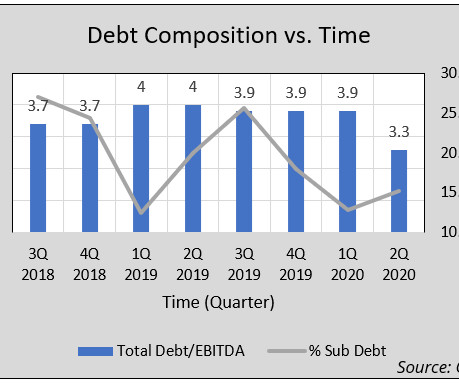

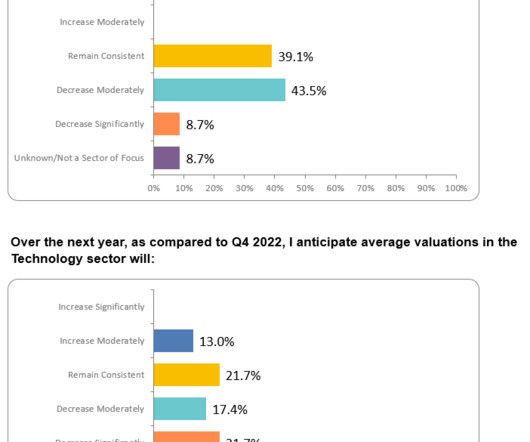

Click to Download: Middle Market Private Equity M&A Activity – Q2 2020 Executive Summary Transaction Volume Shrinks Only 31 transactions were reported in Q2 2020, bringing the total reported transactions in 2020 to 113. Debt Usage Decline In Q2 2020, total debt to EBITDA fell to 3.3x the prior quarter.

Let's personalize your content