The data dividend: Fueling generative AI

Mckinsey and Company

SEPTEMBER 15, 2023

Data leaders should consider seven actions to enable companies to scale their generative AI ambitions.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Mckinsey and Company

SEPTEMBER 15, 2023

Data leaders should consider seven actions to enable companies to scale their generative AI ambitions.

Musings on Markets

MARCH 5, 2025

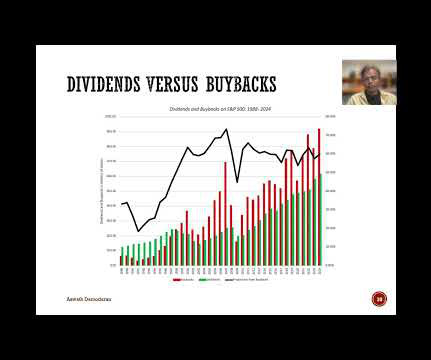

I also look at a clear and discernible shift away from dividends to stock buybacks, especially in the US, and examine both good and bad reasons for this shift. Some of that cash will be held back in the company as a cash balance, but the balance can be returned either as dividends or in buybacks.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Andrew Stolz

FEBRUARY 7, 2022

Massive dividend yield secured by strong cash generation. Cash machine ensures consistent massive dividend yield. It consistently delivered strong FCFF that were more than sufficient to cover high dividends. The FCF yield shows ROEC’s dividend-paying potential. LG) shift to OLED technology.

Musings on Markets

JANUARY 10, 2025

Breaking down companies by (S&P) sector, again both in numbers and market cap, here is what I get: While industrials the most listed stocks, technology accounts for 21% of the market cap of all listed stocks, globally, making it the most valuable sector. Dividends and Potential Dividends (FCFE) 1. Beta & Risk 1.

Global Finance

FEBRUARY 5, 2025

A Country Of Superlatives Joel Shen, a lawyer based in Jakarta and Singapore, who heads Withersworldwides technology practice in Asia, boasts that Indonesia is a country of superlatives and is an attractive investment destination with a number of very clear advantages. GDP per capita (2024): $5,000 GDP growth (2024): 5% Inflation (2024): 2.5%

Equilest

MAY 10, 2023

To dive deeper into the impact of dividend payout ratios on business valuation, continue reading below When investors look to invest in a company, one of the key metrics they use to evaluate the company's value is the dividend payout ratio.

Benzinga

APRIL 5, 2023

With over a decade of investment into AI and one of the leading research institutes in place, Meta is at the very forefront, said Andrew Bosworth, the company's chief technology officer, in an exclusive interview with Nikkei. FedEx's board approved an increase in the annual dividend rate on its common stock of 10%, or $0.44

Benzinga

DECEMBER 29, 2023

An update is provided on several matters of importance for Shareholders including the acquisition, an associated dividend for ILUS Shareholders, merger agreement negotiations, subsidiaries, and financing. The company has signed contracts to acquire the controlling interest of an OTC listed SEC Reporting company.

Benzinga

JANUARY 12, 2024

Technology services revenue increased to $379 million from $353 million the prior year, reflecting the onboarding of several large clients. Investment advisory, administration fees, and securities lending revenues increased to $3.61 billion from $3.40 BLK stated that the net inflow stood at $96 billion in Q4 and $289 billion in FY23.

Global Finance

DECEMBER 27, 2024

As long as foreign companies fulfill all tax obligations and issue a dividend notice, they can repatriate profits without any penalty. Another gain from the new Investment Act is the establishment of a fair and investor-friendly framework for the repatriation of profits. In 2023, they signed agreements worth $667 million.

Benzinga

MAY 6, 2022

New York, May 06, 2022 (GLOBE NEWSWIRE) -- Proactive, provider of real-time news and video interviews on growth companies listed in the US and Canada, has covered the following companies: CULT Food Science announces share exchange, license agreement with Cella Foods to advance technology click here.

Valutico

AUGUST 30, 2023

Dividend Policy: For mature companies with stable cash flows, the Terminal Growth Rate helps determine an appropriate dividend policy. The rate at which dividends can grow sustainably is linked to the Terminal Growth Rate.

Benzinga

APRIL 26, 2023

Net Interest and Dividend Income Tax equivalent net interest income of $11.3 See SUPPLEMENTAL INFORMATION – Net Interest and Dividend Income on page 9 of this release for additional details. million, were partially offset by common stock dividends paid of $0.9 Non-Interest Income Non-interest income of $2.7

Benzinga

MARCH 5, 2024

Spirent offers products, services and managed solutions that address technologies’ test, assurance and automation challenges, including 5G, software-defined wide area networks (SD-WAN), cloud and autonomous vehicles. pence per share in cash along with a special dividend per share of 2.5

Benzinga

SEPTEMBER 16, 2024

We have a Zacks Rank #2 (Buy) on ACN shares, given the company's technological prowess, strong cash position, contribution from acquisitions and consistent dividend payouts. Technology-Based Growth Strategy Accenture's broader growth strategy focuses on delivering comprehensive value to its stakeholders through technology.

ThomsonReuters

NOVEMBER 19, 2024

← Blog home The emergence of new trends now has serious implications for medical technology (MedTech) companies and their ability to maintain compliance with indirect tax (IDT) rules and regulations. Emerging technologies. For instance, licensing medical technology to foreign distributors or partners could trigger withholding taxes.

Musings on Markets

MAY 20, 2022

In a final assessment, I break down companies based upon operating cash flows (EBITDA as a percent of enterprise value) and dividend yield (dividends as a percent of market capitalization).

Benzinga

NOVEMBER 23, 2022

S&P Global reported that healthcare REITs have a five-year average dividend yield of 5.2%, while office REITs hold an average dividend yield of 2.9%. See Also: 3 Mortgage REITs With Yields Of Over 13% And Trading For Far Less Than They're Worth.

Benzinga

APRIL 28, 2023

With the success of the first quarter, the Board announced a quarterly cash dividend of $0.20 million in dividends during the first quarter of 2023. Our focus throughout the remainder of 2023 will be on continued quality growth in loans and deposits, a laser focus on expense control and a laser focus on asset quality. 31, 2023 Dec.

Global Finance

DECEMBER 3, 2024

The agricultural sector has been transformed, with several programs implemented to boost trade and provide farmers with access to essential technology, supplies and funding. Manufacturing has seen a significant boost, contributing over $55 billion to the economy in 2023. billion in 2018 to $5.8 billion in 2023). Third is our reforms.

Benzinga

JULY 17, 2024

By implementing process innovations to increase capacity and improve efficiency using proven technology utilized at other Kronos facilities, we will be better positioned to serve our customers.

Global Finance

JUNE 9, 2025

Most Innovative Financial Technology Company in Africa | MNT – HALAN MNT-Halan has been transforming access to financial services for African consumers and businesses. The solution is helping Absa pivot to new technologies as the market evolves, without disrupting existing workflows. With over 2.4

Valutico

OCTOBER 1, 2022

The company researches, develops, designs, manufactures, integrates, and operates technology systems, products, and services in the defense industry. dividend yield and an ongoing share buyback program. . Given the stable dividend payout ratio of ~65%, we also performed utilized a Dividend Discount Model with a Cost of Equity of 6.3%

Musings on Markets

APRIL 7, 2025

Breaking down just US equities, by sector, we can see the damage across sectors: The technology sector lost the most in value last week, both in dollar terms, shedding almost $1.8 There was undoubtedly some panic selling on Friday, but the flight to safety, whether it be in moving into treasuries or high dividend paying stocks, was muted.

Musings on Markets

JANUARY 17, 2024

The first is that it was an uneven recovery, if you break stocks down be sector, which I have, for both US and global stocks, in the table below: As you can see, technology was the biggest winner of the year, up almost 58% (44%) for US (global) stocks, with communication services and consumer discretionary as the next best performers.

Benzinga

JUNE 23, 2025

Strategic Value Creation: ILUS continues to evaluate uplist, spinoffs, partnerships, and dividend-based structures to unlock and return shareholder value. ILUS also highlighted its positions in external entities, including Fusion Fuel Green PLC (NASDAQ: HTOO ).

Valutico

OCTOBER 7, 2022

is a US-based computer technology firm that develops PCs, laptops, and printers. billion to their shareholders as the company repurchased shares and paid out dividends. HP is also interesting for long-term investors as they are offering an attractive dividend yield of just over 3%. Link to the detailed valuation.

Musings on Markets

JANUARY 11, 2024

Most of you are not enrolled at NYU, paying nosebleed prices, and that is prerequisite to be in the classroom, but thanks to technology and a loose reading of the rules that constrain me, you can get a close approximation of the classroom experience, wherever you are in the world, with broadband being your only constraint.

Andrew Stolz

FEBRUARY 2, 2022

Attractive dividend yield could rise above 5%. Attractive dividend yield could rise above 5%. Also, the dividend yield might be worth a look from an investor perspective. Key risk is failure to keep up with technological trends. Lagging technological developments. EV market might turn into growth catalyst soon.

Equilest

MAY 29, 2023

As an essential component of shareholders' equity, retained earnings reflect the accumulated profits that a company has chosen to reinvest rather than distribute as dividends. Calculating retained earnings is relatively straightforward, involving subtracting dividends and distributions from net income over a specific period.

Global Finance

SEPTEMBER 9, 2024

Corporates are hoarding cash, and that has meant a return to dividends and distributions but also more conservative cash management. Technology has been a big driver and enabler of that,” he says, “due to the need for greater visibility of payments, balances, settlements, and counterparty risks.”

Andrew Stolz

JANUARY 17, 2022

Value play with strong dividend growth potential. Strong operating cash flow allows the company to resume its dividend payments in line with its pre-pandemic policy. I expect dividend yield over the near-term to range between 2.5-3.5%. Strong cash flow generation is crucial for returning dividends to shareholders.

Benzinga

OCTOBER 7, 2024

million of incremental value from annual merger enabled cost savings and synergies, and Hope Bancorp's dividend, which is more than 1,000% higher than Territorial's standalone quarterly dividend. Blue Hill's registered business address appears to be a residential home in Hudson, New York. per share to $0.11

Andrew Stolz

JANUARY 27, 2022

Attractive dividend yield despite rise in invested capital. This includes pharmaceuticals, nutrition, medical technology, AI, robotics, cloud service provider, infrastructure, batteries for electric vehicles, and many more. Attractive dividend yield despite rise in invested capital. Download the full report as a PDF.

Valutico

MARCH 20, 2023

This acquisition is expected to strengthen HSBC’s commercial banking franchise and enhance its ability to serve innovative and fast-growing firms, particularly in the technology and life science sectors, both domestically and globally. HSBC is also planning a special dividend of $0.21

Benzinga

NOVEMBER 22, 2023

SciSparc seeks to scale up revenues and will consider transferring its pharmaceutical activities to a separate legal entity and explor ing the possibility of dividend distributi on TEL AVIV, Israel, Nov. SciSparc will explore the possible distribution of NewCo shares as dividend in kind to its shareholders.

Brian DeChesare

MAY 14, 2025

AI and Technological Advances The massive growth in data and compute required for AI-enabled applications is driving data center demand and the energy required to support all these data centers. So, if your goal is to be a true generalist, I would still rank infrastructure below groups like consumer retail, technology, and healthcare.

Sun Acquisitions

SEPTEMBER 27, 2024

By integrating MuleSoft’s technology into its ecosystem, Salesforce fortified its position as a comprehensive customer relationship management platform, offering enhanced connectivity and value to its clients. A prime example is Salesforce’s acquisition of MuleSoft, a leading integration software provider, for $6.5

Musings on Markets

NOVEMBER 9, 2021

I would be lying if I said that I have had clarity about Tesla's story over the last decade, because it has so many tangents, distractions and shifts along the way, flirting with narratives about being a battery company, an energy company and a technology company.

Global Finance

MARCH 6, 2025

Latvia anticipates a dividend from its largest-ever trade mission to the US, in September 2024. Latvia offers a vibrant technology ecosystem, skilled workforce, strong IT infrastructure, and favorable government policies, says Birendra Sen, head of BPS at Tech Mahindra. We are at an important step in our Baltic growth strategy.

Andrew Stolz

NOVEMBER 21, 2021

The company pays out dividends on a consistent basis. Dividend payout ratio is almost constant around 30%. Failure to keep up with technological changes could result in loss of market share. Solid dividend and share buyback offer attractive return even without upside. Cash flow – Toyota. That should improve in 2022.

Benzinga

NOVEMBER 6, 2024

Through this all-stock merger, Territorial shareholders will be able to participate in the significant upside value creation of a scaled, more diversified regional bank with an attractive dividend and compelling growth opportunities. Kitagawa, Chairman, CEO and President of Territorial. "We

Global Finance

MAY 1, 2025

Kuwait | BOUBYAN BANK Boubyan Bank stands apart as the leading technology-backed bank in Kuwait. In 2024, the bank increased its capital from 20 billion to 25 billion Saudi riyals via stock dividends, to fund the next growth stage. Both financing and deposits continue to expand, and its digital- banking platform is expanding.

ThomsonReuters

MAY 15, 2024

Withholding taxes: Changes in sourcing locations can alter the application of withholding taxes on royalties, dividends, and other payments between related entities. Invest in technology: Utilize real-time cargo tracking technology to monitor your shipments and react to disruptions promptly.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content