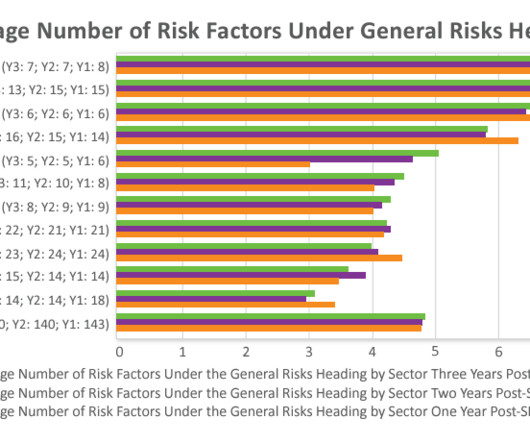

SEC Risk Factors Disclosure Analysis

Harvard Corporate Governance

DECEMBER 3, 2023

Opportunities remain to better align external risk reporting with internal risk management and reporting processes, improve the readability and categorization of risks, and make disclosures less generic.

Let's personalize your content