11 Largest Leveraged Buyouts Of All Time

Benzinga

APRIL 27, 2022

A leveraged buyout is simply defined as the purchase of a controlling share in a company by its management using outside capital.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

companies capital-bank-corp

companies capital-bank-corp

Benzinga

APRIL 27, 2022

A leveraged buyout is simply defined as the purchase of a controlling share in a company by its management using outside capital.

Benzinga

SEPTEMBER 23, 2022

Troubled Credit Suisse Slides To 52-Week After Report On Raising Fresh Capital. Credit Suisse Group AG (NYSE: CS ) shares fell after reports that the company is looking to raise fresh capital. China Southern Airlines Places Order With Airbus For 40 Jets. The order is expected to be worth about $4.85

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Law 360 M&A

SEPTEMBER 6, 2022

Texas Capital Bancshares Inc. billion to bank holding company Truist Financial Corp., the companies said Tuesday, in a transaction led by respective legal advisers Cravath Swaine & Moore LLP and Willkie Farr & Gallagher LLP. has agreed to sell its insurance premium finance unit for roughly $3.4

Benzinga

MARCH 14, 2024

LOUIS, March 14, 2024 (GLOBE NEWSWIRE) -- Stifel Financial Corp. CBR offers an advanced technology-enabled platform to deliver enterprise risk management, strategic planning, capital planning, and interactive performance-based analytics for community banks nationwide. "We Finance 500") and CB Resource, Inc. ("CBR").

Benzinga

DECEMBER 29, 2023

If any such shareholders have questions or need assistance in connection with the Meeting, please contact the Company's proxy solicitor, Advantage Proxy, Inc, by calling 877-870-8565, or by emailing ksmith@advantageproxy.com. The Company's asset-light business model means it neither owns nor operates any aircraft.

Benzinga

DECEMBER 27, 2023

If any such shareholders have questions or need assistance in connection with the Meeting, please contact the Company's proxy solicitor, Advantage Proxy, Inc, by calling 877-870-8565, or by emailing ksmith@advantageproxy.com. The Company's asset-light business model means it neither owns nor operates any aircraft.

Benzinga

FEBRUARY 23, 2023

billion and a combined market capitalization of approximately $130 million. The combined company will have 18 branches, with a retail and lending presence covering Wooster, Ohio to Wheeling, West Virginia with exposure to the major metropolitan areas of Cleveland, Akron, Canton, Youngstown, and Pittsburgh. as of February 22, 2023.

Law 360 M&A

SEPTEMBER 22, 2022

DMB Acquisition Corp., the third special purpose acquisition company formed by life sciences-focused investment bank LifeSci Capital LLC, withdrew plans Thursday for a $75 million initial public offering, marking the latest setback for the SPAC market.

Benzinga

DECEMBER 1, 2022

appointed as President of Middlefield Banc Corp. and The Middlefield Banking Company. 01, 2022 (GLOBE NEWSWIRE) -- Middlefield Banc Corp. Liberty's former President and Chief Executive Officer, has assumed the role of President of Middlefield Banc Corp. and The Middlefield Banking Company.

Benzinga

JANUARY 6, 2023

06, 2023 (GLOBE NEWSWIRE) -- Newtek Business Services Corp. NBNYC has been renamed Newtek Bank, National Association ™ ("Newtek Bank, N.A.") and has become a wholly owned subsidiary of the Company. NBNYC has been renamed Newtek Bank, National Association ™ ("Newtek Bank, N.A.") BOCA RATON, Fla.,

Benzinga

JUNE 5, 2023

Wall Street Journal Megabanks Beware: Regulatory Big Brother Wants a Tighter Leash Amid Recent Bank Failures U.S. regulators are reportedly gearing up to enforce stricter measures on large banks to enhance their financial stability following a series of failures among midsize banks earlier this year.

Benzinga

DECEMBER 1, 2022

01, 2022 (GLOBE NEWSWIRE) -- Newtek Business Services Corp. NASDAQ: NEWT ) ("Newtek") today announced that it has received conditional approval from Office of the Comptroller of the Currency ("OCC") to complete its acquisition of the National Bank of New York City ("NBNYC" and the "Acquisition"). BOCA RATON, Fla.,

Benzinga

JUNE 7, 2022

LOUIS and FRANKFURT, Germany, June 07, 2022 (GLOBE NEWSWIRE) -- Stifel Financial Corp. NYSE: SF ) today announced it has signed a definitive agreement to acquire ACXIT Capital Partners, a leading independent corporate finance and financial advisory firm serving European middle-market clients and entrepreneurs.

Benzinga

FEBRUARY 13, 2023

NASDAQ: HTBI ) ("HomeTrust"), the holding company of HomeTrust Bank, today announced that its merger with Quantum Capital Corp. ASHEVILLE, N.C., 13, 2023 (GLOBE NEWSWIRE) -- HomeTrust Bancshares, Inc. Quantum") was completed as of February 12, 2023. million (the "Transaction"). ."

Benzinga

MAY 26, 2022

MIDDLEFIELD, Ohio and ADA, Ohio, May 26, 2022 (GLOBE NEWSWIRE) -- Middlefield Banc Corp. Middlefield", or the "Company") (NASDAQ: MBCN ), the bank holding company for The Middlefield Banking Company, and Liberty Bancshares, Inc. In addition, Mr. Zimmerly will become President of Middlefield Banc Corp.

Benzinga

JUNE 2, 2023

June 02, 2023 (GLOBE NEWSWIRE) -- Seaport Global Acquisition II Corp. NASDAQ: SGII ) ("SGII"), a publicly-listed special purpose acquisition company, and American Battery Materials, Inc. NASDAQ: SGII ) ("SGII"), a publicly-listed special purpose acquisition company, and American Battery Materials, Inc.

Benzinga

OCTOBER 10, 2022

will indirectly own a majority of the new public company, named XBP Europe Holdings, Inc. NASDAQ: XELA , XELAP)) ("Exela") and CF Acquisition Corp. VIII (NASDAQ: CFFE ) ("CFFE"), a special purpose acquisition company sponsored by Cantor Fitzgerald, today announced that they have entered into a definitive merger agreement.

Benzinga

DECEMBER 14, 2023

~ Revelstone's Special Meeting to Approve Business Combination Scheduled for December 27, 2023 for Stockholders of Record as of November 10, 2023 ~ ~ Upon Closing, the Combined Company is Expected to Trade on Nasdaq Under the Ticker "SJET" ~ SCOTTSDALE, Ariz. Advisors Roth Capital Partners is acting as. and NEW YORK, Dec.

Benzinga

APRIL 27, 2022

On April 1 M&T Bank closed its merger with People's United Bank. M&T Bank plans to onboard People's United Bank's retail advisory and brokerage business to LPL's platform in the second half of 2022. M&T Bank recently acquired People's United Bank; the deal closed April 1.

Benzinga

NOVEMBER 16, 2022

AtlasClear will operate through an acquisition of technology assets from Atlas Fintech Holdings Corp., and Craig Ridenhour, Chief Business Development Officer of Atlas FinTech Holdings Corp., will lead the combined company. AtlasClear"), Atlas Fintech Holdings Corp. Robert McBey, CEO of Wilson Davis & Co.,

Benzinga

AUGUST 15, 2022

FLWR, OTC: FLWPF ) (" Flowr " or the " Company ") announces the closing of the previously announced sale of the Flowr Forest property to an arm's length third party for aggregate proceeds of $3.4 The Company, now bank debt free, intends to the use the remaining proceeds for working capital. M shares in Akanda Corp.

Benzinga

DECEMBER 22, 2022

22, 2022 (GLOBE NEWSWIRE) -- Stifel Financial Corp. NYSE: SF ) today announced it has signed a definitive agreement to acquire Torreya Partners LLC ("Torreya"), a leading independent M&A and private capital advisory firm serving the global life sciences industry. LOUIS, Dec. Terms of the transaction were not disclosed.

Benzinga

JUNE 3, 2022

(NYSE: STON ) (" StoneMor " or the " Company "). a Delaware corporation (" StoneMor " or the " Company "), Axar Cemetery Parent Corp (" Parent "), a Delaware corporation and an affiliate of Axar Capital Management, LP (" Axar "), and Axar Cemetery Merger Corp., Full story available on Benzinga.com.

Benzinga

DECEMBER 20, 2022

aerial firefighting services company to offer industry-leading tactical expertise and proprietary technological capabilities to combat year-round environmental and economic crises associated with forest fires. Combined company to be listed on NASDAQ under ticker "BAER". 20, 2022 (GLOBE NEWSWIRE) -- Jack Creek Investment Corp.

Benzinga

MARCH 30, 2023

MIAMI, March 30, 2023 (GLOBE NEWSWIRE) -- Liberty Resources Acquisition Corp. Through a complex restructuring PubCo will become the resultant amalgamated parent company and is expected to continue a listing on the Nasdaq Stock Exchange ("NASDAQ"). He was also on the Board of ExxonMobil.

Benzinga

NOVEMBER 18, 2022

18, 2022 (GLOBE NEWSWIRE) -- Wallbridge Mining Company Limited (TSX: WM , OTCQX: WLBMF ) ( "Wallbridge" or the "Company" ) today announced that it has completed the previously-announced sale of all of the property, assets, rights, and obligations related to Wallbridge's portfolio of nickel assets (the "Transaction" ) to Archer Exploration Corp.

Benzinga

MAY 23, 2022

We added ManTech as a potential deal on February 3, 2022, when Reuters reported that George Pedersen was exploring options for his controlling stake in the company. The investment bank has reached out to ManTech’s peers such as Parsons Corp and Leidos Holdings, as well as private equity firms, to gauge potential acquisition interest."

Benzinga

SEPTEMBER 29, 2023

Fellow Zynerba Pharmaceuticals Stockholders, We urge you to promptly tender your shares in response to the pending tender offer (the "Offer") by Harmony and its wholly owned subsidiary, Xylophone Acquisition Corp. minimum price requirements of the Nasdaq Capital Market. Purchaser").

ThomsonReuters

JUNE 16, 2023

However, most cases of accounting fraud will not make news headlines and can happen in companies of all sizes and industries. A study on the pervasiveness of corporate fraud estimates that in an average year, 41 percent of companies are committing accounting violations, which are less severe than alleged securities fraud.

Benzinga

SEPTEMBER 22, 2022

22, 2022 (GLOBE NEWSWIRE) -- Voxtur Analytics Corp. RPC is managed by Rice Park Capital Management LP ("Rice Park"). TORONTO and TAMPA, Fla., The Acquisition has been approved by the TSX Venture Exchange ("TSXV"). Expansion of Credit Facilities.

Farrel Fritz

JULY 31, 2023

The winding down of an architectural and engineering firm organized as an LLP initially went smoothly, with the three partners agreeing to complete existing jobs and collect receivables to pay off the firm’s bank loan which the three had personally guaranteed jointly and severally. 2023 NY Slip Op 03196 [1st Dept June 13, 2023].

Reynolds Holding

MAY 25, 2023

Investment Company Act of 1940 There is a saying when you’re in the woods. It also helps explain why savers might try to cash out of deposits before that proverbial bear catches them at the bank. 21] Liquidity and dilution management has been a bedrock principle of open-end funds since the passing of the Investment Company Act.

Reynolds Holding

NOVEMBER 28, 2022

In advancing this view, Congress and the regulators appear to be following a path laid out by crypto companies seeking legitimacy through inclusion (on their own terms), in regulated finance. Banks allow savings to be pooled and turned into loans for fruit orchards, solar farms, automobiles, small business, and housing.

Benzinga

OCTOBER 31, 2022

31, 2022 (GLOBE NEWSWIRE) -- Partners Bancorp (NASDAQ: PTRS ) (the "Company"), the parent company of The Bank of Delmarva ("Delmarva"), Seaford, Delaware, and Virginia Partners Bank ("Virginia Partners"), Fredericksburg, Virginia, reported net income attributable to the Company of $4.1 SALISBURY, Md.,

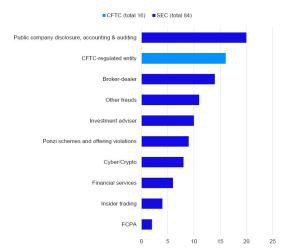

Reynolds Holding

OCTOBER 3, 2023

The actions include public company disclosure and crypto matters, among others. Actions initiated by the SEC and CFTC in July and August 2023 Number of actions, by matter type Public company disclosures Molecular diagnostic company settles misrepresentation claims related to COVID-19 testing products In the Matter of Co-Diagnostics (A.P.

ABI

JANUARY 16, 2020

12] Additionally, the court distinguished In re Peabody Energy Corp. from Bank of America Nat’l Trust & Savings Ass’n v. 12] Additionally, the court distinguished In re Peabody Energy Corp. from Bank of America Nat’l Trust & Savings Ass’n v. Peabody Energy Corp. (In In re Peabody Energy Corp.),

Reynolds Holding

JANUARY 31, 2024

30, 2023, for instance, special-purpose acquisition company-related suits had fallen 37% as compared to the same period in 2022. Plaintiffs instead are targeting companies that allegedly have failed to anticipate supply chain disruptions, persistent inflation, rising interest rates and other macroeconomic headwinds. Through Sept.

Reynolds Holding

MAY 6, 2022

7] Neiman Marcus was no different – in 2017, it transferred its crown jewel asset into a subsidiary that would be out of reach of creditors if the company eventually filed for bankruptcy. [8] 18] Certain features of modern-day distressed capital structures exacerbate this problem. 12] See In re Johns-Manville Corp. , 919 (Bankr.

Benzinga

MAY 11, 2023

In addition, if requested by Allied and AMC, Mondavi will continue the company from British Columbia to Ontario, adopt new by-laws and other corporate policies, increase the size of and reconstitute the board of directors and adopt new security-based compensation arrangements.

Appraiser Newsroom

FEBRUARY 16, 2022

He has over 30 years of experience in investment banking and valuation, specializing in technology companies, rapidly-growing companies, closely-held businesses, professional practices, and intangible assets. Mr. Baker is also a representative of Independent Investment Bankers Corp., Maxime Charlebois, Ph.D. ,

Brian DeChesare

MAY 10, 2023

I’ve found that two main groups care about investment banking in Singapore : Students who are from Southeast Asia and are considering whether they want to work in Singapore, NY, London, or other places. As a result, many companies from nearby countries want to do deals there. If you’re in the first group, congrats!

Reynolds Holding

APRIL 18, 2024

We experienced perfect storms of risk during the SPAC boom with frauds like the one that the SEC alleges was perpetrated by Trevor Milton and the EV company, Nikola. [6] Every day, we see companies attempting to not only develop AI capabilities, or harness it to improve their productivity and growth, but also to attract and retain investors.

Farrel Fritz

JUNE 5, 2023

v Rudd ( AD3d , 2023 NY Slip Op 02936 [1st Dept June 1, 2023]) , involved a publicly-traded company, but the decision is of interest to any business divorce practitioner who represents entities incorporated outside of New York. Motors Corp. , Companies Act. Ezrasons, Inc. v CPF Acquisition Co.,

Reynolds Holding

SEPTEMBER 9, 2022

The Securities Act of 1933 was about companies raising money from the public. Investors could decide which risks to take; companies that issued securities to the public were required to provide full, fair, and truthful disclosures to the public. Other issuers in our capital markets also deserve to compete on a fair playing field.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content