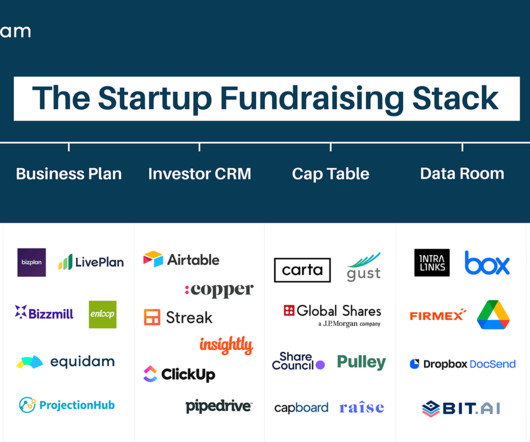

The Startup Fundraising Stack

Equidam

MARCH 23, 2023

LivePlan : A platform that offers a step-by-step guide for creating a business plan, including financial forecasting tools and customizable templates. Cap Table Cap table management tools can help you keep track of your equity and ownership percentages as you take on investment and bring on new team members.

Let's personalize your content