Data Update 5 for 2023: The Earnings Test

Musings on Markets

FEBRUARY 15, 2023

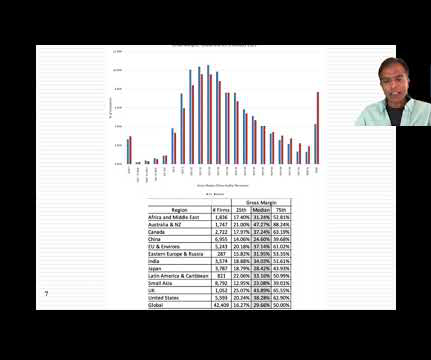

Some of that variation can be attributed to different mixes of businesses in different regions, since unit economics will result in higher gross margins for technology companies and commodity companies, in years when commodity prices are high, and lower gross margins for heavy manufacturing and retail businesses.

Let's personalize your content