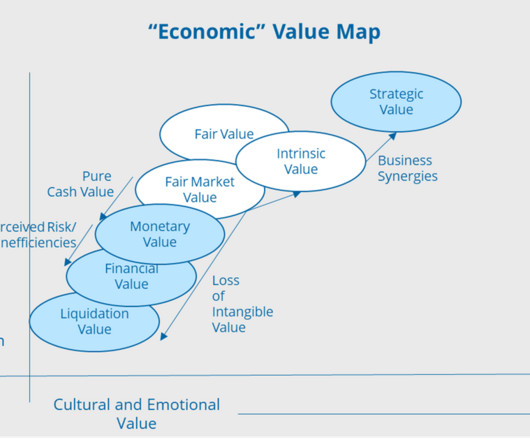

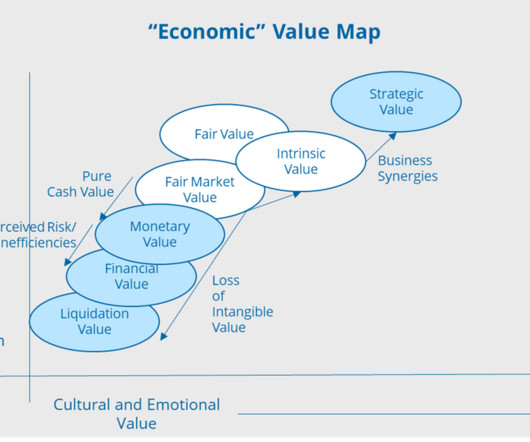

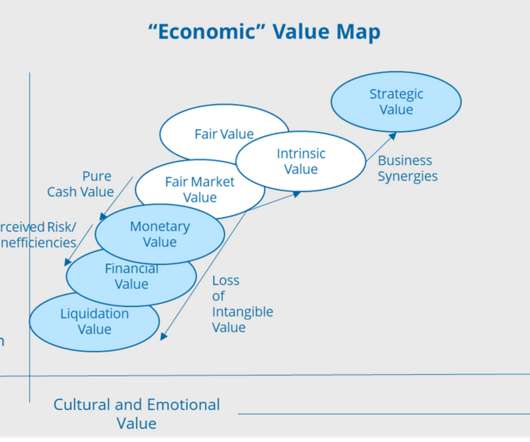

Transcending Value – Liquidation, Monetary, Financial, and Strategic Value

Value Scope

JUNE 2, 2021

Liquidation, Monetary, Financial, and Strategic Value The liquation value is simply the FMV without the intangible assets of the business unless certain intangibles such as patents can be separately sold/licensed and utilized by another firm. The monetary value is just what it says, pure cash value without regard to any psychic benefits.

Let's personalize your content