Preparing to Choose Your SOX Operating Model: Three Key Steps

Audit Board

SEPTEMBER 15, 2022

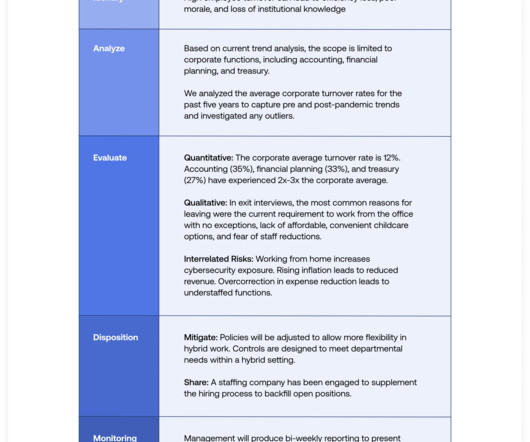

Your organization’s SOX operating model is the core of your SOX program. Accordingly, your choice of operating model has a massive impact on your ability to plan and execute an efficient, effective, high-quality SOX program. Understand the Four SOX Operating Models. Understand the Four SOX Operating Models.

Let's personalize your content