Enterprise Risk Management (ERM) Fundamentals

Audit Board

AUGUST 8, 2023

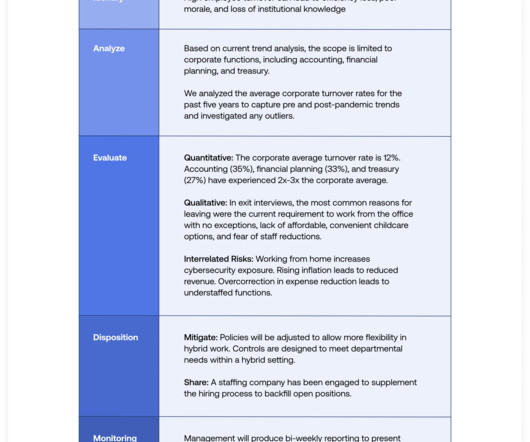

Enterprise risk management is a methodology of risk management, taking a top-down approach to the risk management process, and taking into account the organization and senior management’s business objectives and strategic objectives.

Let's personalize your content