Are Financial Firms Ready for Climate Regulation?

Reynolds Holding

APRIL 7, 2024

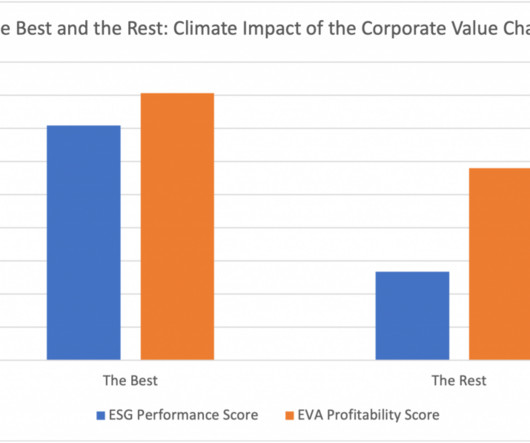

This post uses data from the ISS ESG Corporate Rating and from ISS Economic Value Added (EVA ) to assess the readiness of financial companies, across different markets and regulatory jurisdictions, to meet this challenge. ISS ESG research has previously highlighted Taiwan’s ESG transparency.)

Let's personalize your content